How to Become a Crypto Market Maker

May 21, 2024

Market makers have always been vital because they support smooth trading, reduce volatility, tighten bid-ask spreads, and act as liquidity engines on the financial market. Blockchain adoption speeds up and digital assets go mainstream, thus crypto market makers are becoming increasingly important for building stable, investable token economies.

But how to become a crypto maker? Why are they vital for early-stage crypto projects and institutional players both? What goals do they perform?

What Is a Crypto Market Maker?

Knowing the fundamental role that cryptocurrency market makers play in the trading of digital assets will make it easier to decide how to get started in the cryptocurrency space.

A crypto market maker is a participant, usually a professional trading firm or algorithmic liquidity provider, that continuously quotes buy and sell prices for particular tokens across market making crypto exchanges. This dual quoting ensures active order books and seamless trade execution even when there are no direct matches between buyers and sellers.

In the decentralised cryptocurrency space, liquidity is dispersed among aggregators, central exchanges (CEXs), and decentralised exchanges (DEXs). This fragmentation can lead to price discrepancies and thin order books. By stabilising cryptocurrency token prices, minimising slippage, and preserving balanced liquidity across venues, crypto market makers aid in closing this gap.

Who Can Become a Market Maker in Crypto?

Now that the main functions of market makers are clear, another question arises: who actually takes on this role in the crypto ecosystem?

The cryptocurrency market-making industry is more varied than it might initially seem. A range of players like highly specialised crypto trading companies or blockchain-native teams take on this role, each contributing to market stability and efficiency in unique ways.

At the forefront are specialised crypto-native services. These companies are built specifically to provide liquidity across digital asset markets. Equipped with advanced algorithmic infrastructure and direct integrations with leading exchanges, they operate at scale, offering seamless support to crypto token projects and trading platforms alike.

Additionally, more and more institutional traders are entering the crypto market. Hedge funds, proprietary trading firms, and even traditional asset managers are recognizing the growing importance of liquidity provision in digital markets. Many are leveraging their deep trading expertise and adapting it to the decentralised, high-volatility environment of crypto. To facilitate listings and lessen price inefficiencies between pairs, certain exchanges and Layer 1 ecosystems are creating internal market-making capabilities or forming strong alliances with reliable liquidity providers.

In certain instances, project teams themselves adopt a more straightforward strategy. Particularly in the early phases of token adoption, some token issuers create or contract out custom market making strategies in order to keep stricter control over liquidity and lessen reliance on outside suppliers.

Although their profiles may differ, successful market makers share a combination of technological sophistication, capital strength, and a sophisticated grasp of the dynamics of liquidity in rapidly shifting, frequently fragmented markets..

Why Market Makers Are Critical for Early-Stage Crypto Projects

Beyond their general role in maintaining efficient markets, market makers are especially vital during a token’s early stages of growth and adoption.

Creating a trading environment with deep liquidity, stable pricing, and seamless execution is one of the main objectives of market making. These circumstances make it easier for investors to get involved and promote active trading, both of which increase liquidity. Market makers contribute to the initiation and maintenance of this flywheel effect.

Because there is less organic volume and price discovery during new token launches or Initial Exchange Offerings (IEOs), this is particularly crucial. These tokens frequently experience low visibility, wide spreads, and volatile price action in the absence of external liquidity support.

Providing Liquidity: How It Works and Why It Matters

It's worthwhile to investigate the practical operation of liquidity provision in order to gain a deeper understanding of the influence of market makers.

Liquidity refers to how easily and efficiently an asset can be bought or sold without significantly impacting its price. In addition to lowering trading costs, high-liquidity markets facilitate speedy transactions with little slippage.

Crypto market makers help maintain high liquidity by continuously quoting buy and sell orders. This enables investors to trade in large amounts at any time, without triggering significant price swings or waiting long periods for counterparties.

By consistently quoting buy and sell orders, cryptocurrency market makers contribute to the maintenance of high liquidity. Because of this, investors can trade in big quantities whenever they want without having to wait a long time for counterparties or cause large price swings.

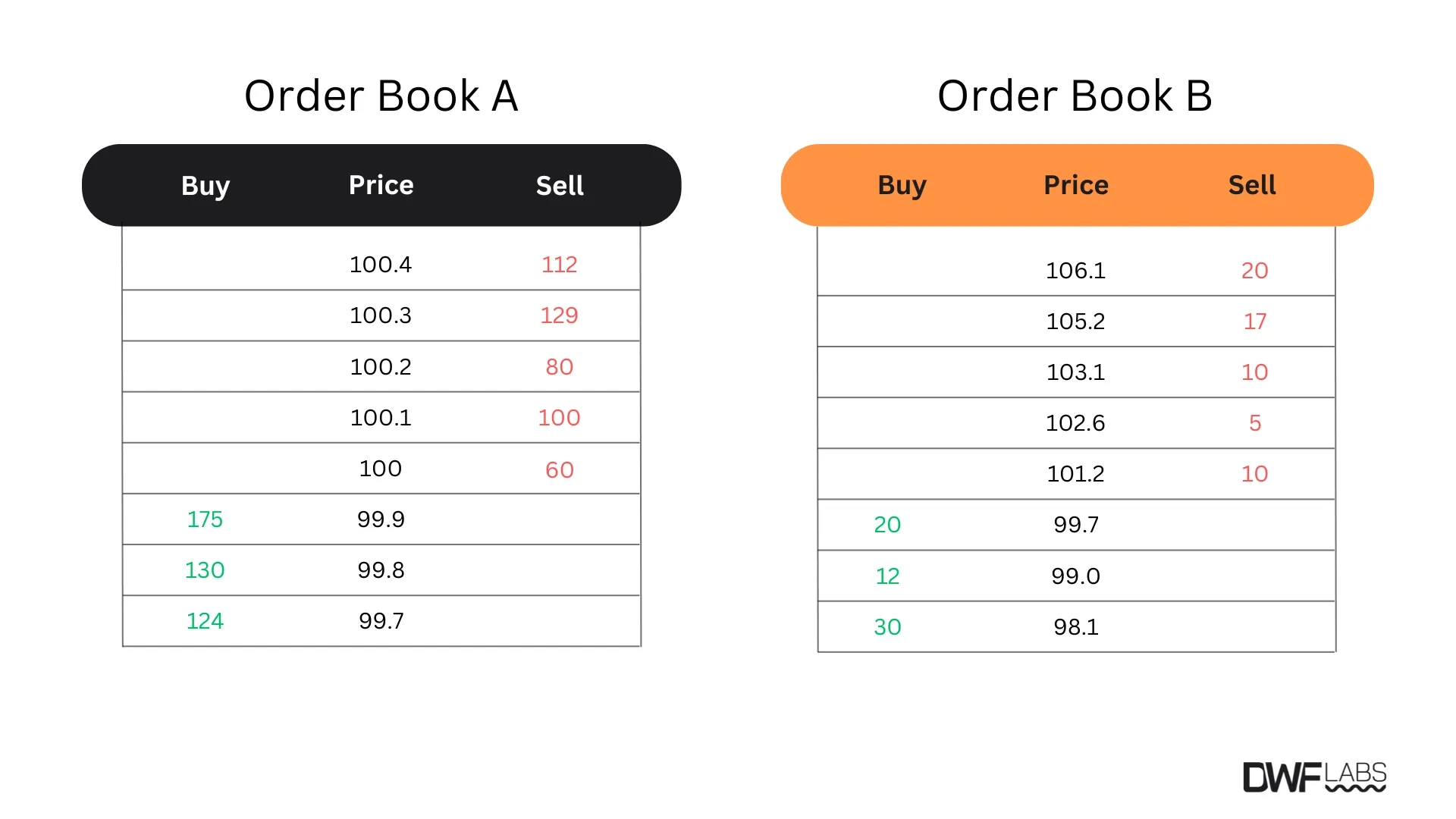

Let’s say, an investor needs to purchase 40 tokens immediately, they can buy all 40 at $100 each on a highly liquid market (Order Book A). However, in a low-liquidity market (Order Book B), they face two options:

- Buy 10 tokens at $101.2, 5 tokens at $102.6, 10 tokens at $103.1, and 15 tokens at $105.2, resulting in an average purchase price of $103.35;

or - Wait for a long period until the tokens reach their desired price.

Liquidity is critical for early-stage token projects, as trading in illiquid markets can negatively impact investor confidence and strategy, which can potentially lead to the project’s failure.

Market Depth and Price Stability: The Unsung Benefits

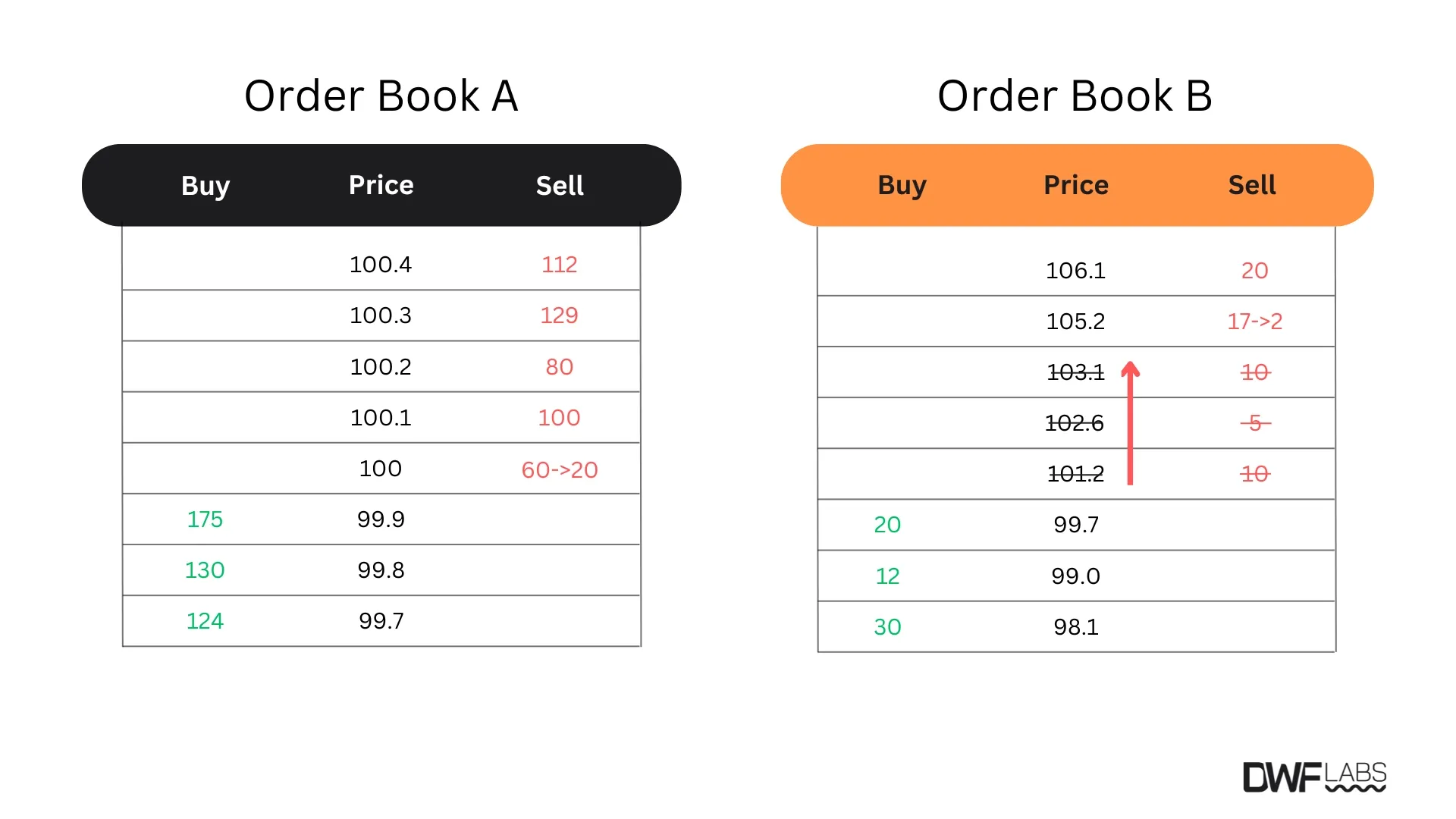

In the cryptocurrency market, most assets suffer from low liquidity and a lack of market depth, meaning that even relatively small trades can cause significant price fluctuations.

In the scenario above, after an investor purchases 40 tokens, the next available price in Order Book B jumps to $105.2, indicating that a single transaction triggered a price movement of approximately 5%. This issue becomes even more pronounced during periods of market volatility, when fewer participants are active and prices are more susceptible to a high level of liquidity provided by market makers results in a narrow bid-ask spread within the order book. These tight spreads are typically accompanied by strong market depth, which helps stabilize asset prices and reduce volatility.

Market depth refers to the number of buy and sell orders available at various price levels in the order book at any given moment. It also indicates an asset’s ability to absorb large orders without causing significant price fluctuations.

Market makers play a crucial role in maintaining this balance by supplying liquidity and bridging the gap between supply and demand. Consider this: which of the following markets would you rather trade in: the one with deep liquidity and minimal slippage, or one with thin order books and wide spreads?

So the role of a crypto market maker is:

- Providing substantial liquidity, and that means ensuring that assets can be bought or sold with minimal price impact.

- Enhancing market depth – which contributes to price stability and ultimately strengthens investor confidence in the project.

By maintaining active order books and narrowing spreads, market makers help create a more reliable and efficient trading environment, which is essential for long-term growth and trust in any crypto project.

Alternative Liquidity Options

While most trading activity occurs on exchanges, market makers also support the ecosystem through other channels such as over-the-counter (OTC) trading.

OTC trading, in which large buy or sell orders are carried out privately as opposed to through a public order book, can assist large investors. By avoiding the inefficiencies that usually occur when large trades disturb market pricing, this strategy helps reduce slippage.

For example, if an institutional investor wishes to enter the cryptocurrency market with a sizable position, doing so directly on a decentralised or low-liquidity exchange may result in adverse execution and a significant price impact. By working with a market maker through an OTC desk, the investor can gain access to deeper liquidity and more stable pricing, making this an attractive option for both investors and token projects managing strategic allocations.

However, facilitating large trades and maintaining tight spreads across volatile markets comes with exposure to significant financial risk, making robust risk management strategies an essential part of any market maker’s operations.

How to Choose a Crypto Market Maker

If you're considering working with a market maker, the next step is knowing what to look for and how to choose the right one.

While liquidity provision remains central, other factors such as uptime reliability, market coverage, regulatory compliance, capital strength, and service transparency are equally important. A capable market maker doesn’t just improve price execution, they contribute to deeper market resilience, reduced slippage, and more consistent trading experiences.

Choosing the right partner involves evaluating not only technical capabilities, but also ethical standards, responsiveness, and alignment with your long-term goals. For token issuers, exchanges, and institutions alike, this decision can significantly influence a project's credibility and the health of its secondary markets.

Although the provision of liquidity is still crucial, other elements like market coverage, capital strength, regulatory compliance, uptime dependability, and service transparency are just as significant. In addition to enhancing price execution, a skilled market maker also helps to increase market resilience, decrease slippage, and provide more reliable trading experiences.

Managing Risk: The Core of Sustainable Market Making

Because market makers hold large inventories of volatile digital assets, they face constant exposure to price fluctuations, liquidity shocks, and platform-specific risks like slippage or failed trades. To stay profitable and maintain liquidity, they implement advanced hedging techniques, automate position balancing across multiple venues, and monitor key metrics like inventory drift and volatility indexes.

For example, delta-neutral strategies help market makers reduce directional risk by balancing long and short positions, while real-time analytics assist in identifying arbitrage opportunities and mispricings across fragmented markets. Additionally, exposure caps and automated stop-loss mechanisms are used to avoid outsized losses during extreme market events.

Effective risk management is what allows market makers to operate confidently across multiple pairs, exchanges, and market conditions without compromising the quality of liquidity they provide.

Top Crypto Market Makers to Know in 2024

In the decentralised finance (DeFi) and digital asset ecosystem, several organizations have emerged as key participants in crypto market making. These firms typically provide liquidity across centralized and decentralised exchanges, contributing to improved market efficiency, narrower spreads, and more consistent trading conditions.

DWF Labs

As a next-generation Web3 investor and market maker, DWF Labs operates one of the world's largest high-frequency cryptocurrency trading entities. They trade both spot and derivatives markets across over 60 top exchanges, offering robust market performance and liquidity solutions for Web3 tokens.

GSR

GSR highlights its role as a trading firm and liquidity provider with over ten years of experience. The firm notes that it offers market making, risk management, and algorithmic execution services across digital asset markets.

Jump Crypto

Jump Crypto is a division of Jump Trading Group, outlines its focus on Web3 infrastructure and research-driven market participation. Its work spans trading, liquidity provision, and blockchain protocol development.

Wintermute

It is presented as a global algorithmic trading firm focused on digital assets. The company states it provides liquidity across a wide range of tokens and platforms, including both CEXs and DEXs.

Conclusion

Becoming a crypto market maker involves more than deploying capital, it requires a comprehensive understanding of liquidity dynamics, market structure, and risk management. From quoting continuous buy and sell prices to participating across fragmented markets, market makers serve as critical infrastructure within the Web3 economy.

To get started, aspiring market makers need access to sufficient capital reserves, a robust trading infrastructure—often algorithmic in nature—and integrations with centralised and decentralised exchanges. They also need to implement real-time risk controls and develop strategies that adapt to volatility, slippage, and liquidity shifts.

As digital asset markets grow, the need for reliable market makers is increasing to help keep prices on the crypto market stable, improve liquidity, and make trading smoother, playing a key role in the development of decentralised finance.