April 2024 had been an eventful month in the world of crypto. From conferences to shifts in market sentiment and the pivotal developments like the Bitcoin halving, it was definitely a month to remember. Read more in a brief summary by DWF Ventures.

Conference Takeaways

Our first stop was the Hong Kong Web3 Festival, where we witnessed the growing potential for Hong Kong to emerge as the next major crypto hub.

With the Hong Kong government fostering a crypto-friendly environment, including the launch of spot Bitcoin ETFs, the region continues to position itself as a leader in digital asset adoption.

Next, we headed to TOKEN2049 in Dubai, which highlighted the city's flourishing crypto ecosystem. Dubai is already home to a thriving community of builders, and the potential for further growth is immense.

During the event, DWF Labs renewed its collaboration with DMCC Crypto Centre as a testament to our bullish outlook on the region. We remain committed to supporting builders and fostering innovation in Dubai.

The Bitcoin Halving

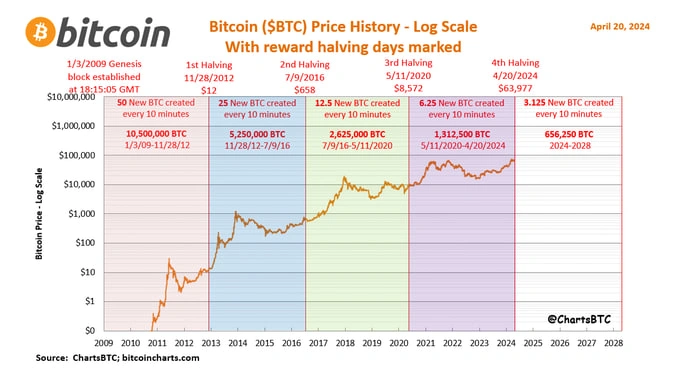

A monumental event occurred on April 20th at 12:00 AM UTC: the Bitcoin halving, which reduced block rewards for miners from 6.25 BTC to 3.125 BTC.

The halving marks a significant milestone in Bitcoin’s monetary policy, as the reduced growth in supply often correlates with an increase in demand and price. With institutional interest fueled by spot Bitcoin ETFs, the sentiment around BTC remains bullish.

Ordinals and Runes

Beyond institutional demand, Bitcoin's ecosystem has seen growing activity around Layer 2 protocols (L2s), in particularly those building using the Ordinals and the Runes Protocol. Ordinals are “NFT-like” digital objects stored on the Bitcoin blockchain that occupy more block space, leading to increased transaction fees. Their popularity has driven new use cases for Bitcoin beyond its traditional role as a store of value.

Bitcoin Layer 2s

With demand for Bitcoin scaling solutions on the rise, L2 solutions are helping expand Bitcoin’s functionality in decentralised applications. We expect many protocols to launch or migrate to Runes after the halving.

Despite concerns around fragmentation and lack of unified standards, we believe that this lays a strong foundation for enhanced use cases and will see mass interest similar to when BRC-20 tokens were launched.

Memecoins: The Power of Community Engagement

Memecoins have proven their staying power as effective tools for community engagement. They are increasingly being used as go-to-market strategies for projects and ecosystems. For example:

- Hyperliquid airdropped $PURR meme tokens to its users, rewarding loyalty.

- Berachain has adopted memes as a core marketing strategy, capturing market mindshare.

While memecoins are often seen as non-fundamental plays, their ability to involve community makes them a powerful force in the current crypto cycle.

Rising Attention on Alternative Layer 1s

Alternative L1 blockchains like TON and Berachain are gaining momentum.

Specifically, TON Blockchain integrated USDT as a native stablecoin, enhancing liquidity and use cases on-chain. Coupled with its synergy with Telegram’s user base, TON looks ready to unlock significant growth.

In the meantime, Berachain and ecosystem, natively employing NFT and DeFi, has attracted a significant attention after a new funding round that reached an impressive $100 million mark.

These developments strengthen the alternative L1s’ competitive position compared to Ethereum.

Other Emerging Narratives and Events to Follow

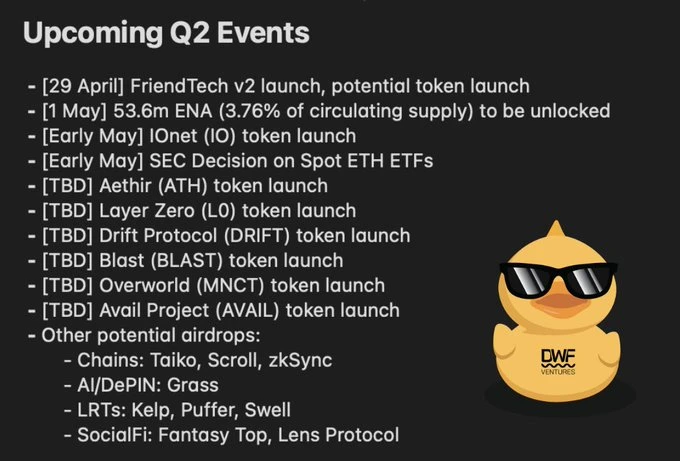

As the market evolves, attention is shifting to emerging trends such as AI and DePIN (Decentralized Physical Infrastructure Networks), restaking, and SocialFi. Key events expected in Q2 include:

- The launch of FriendTech V2 on April 29th, stirring speculation about a token launch.

- Increased activity around Fantasy Top and Lens Protocol, further fueling speculation about token releases.

- Launches of EtherFi and Renzo Protocol tokens, which are driving interest in LRT protocols like KelpDAO, Puffer Finance, and Swell Network.

- Large-scale AI/DePIN projects such as ioNET and AethirCloud, which are likely to dominate the radar.

For more events that may make the waves on the crypto market in Q2 2024, check out the calendar below prepared by DWF Ventures:

Airdrops and Market Sentiment

As market sentiment leans toward uncertainty, airdrops remain a significant driver of attention. Projects across various verticals are leveraging airdrops to engage users and build momentum. These campaigns are expected to play a leading role in shaping market dynamics in the upcoming quarter.

Conclusion

April 2024 highlighted the strenghening momentum of the crypto industry, from the Bitcoin halving to the rise of memecoins, alternative Layer 1s, and emerging narratives. The coming months promise continued changes and growth as markets continue to navigate the fast evolving trends.

As a crypto venture capital fund, we remain committed to supporting builders. Connect with DWF Ventures to discuss partnership opportunities.