TON and Notcoin are skyrocketing!

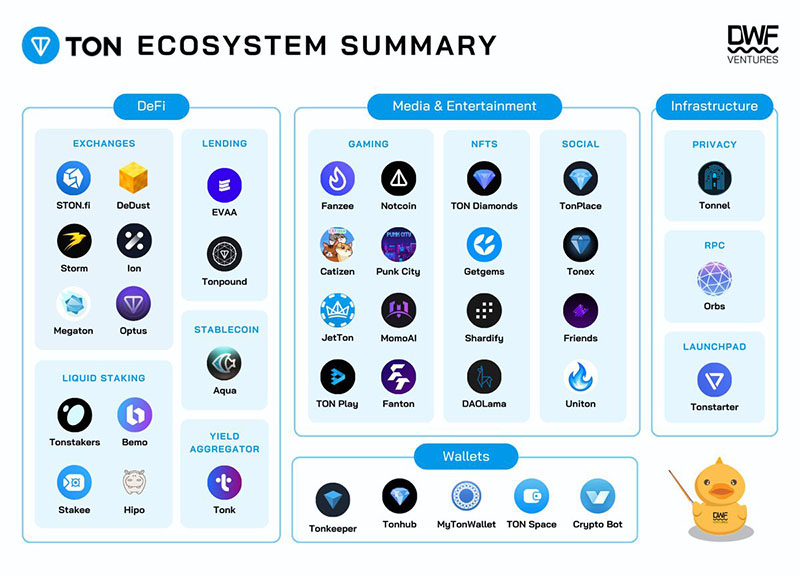

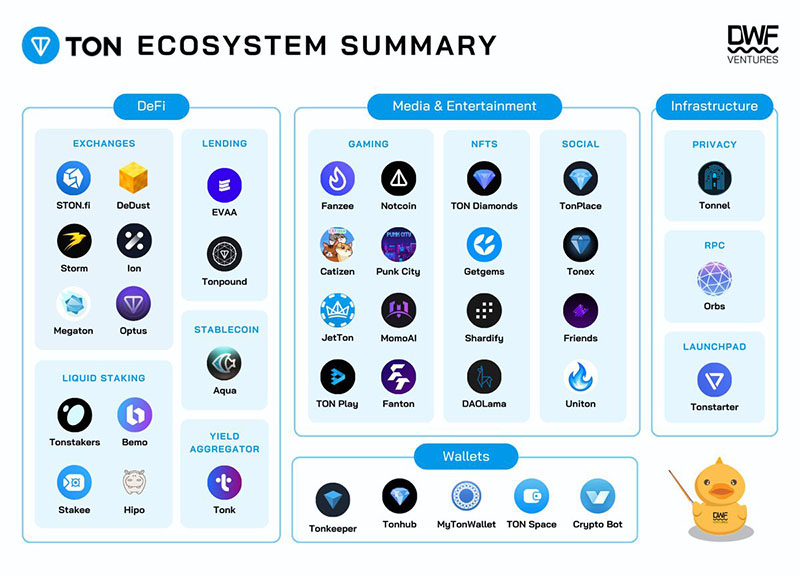

As a long-time supporter of the TON ecosystem, we have compiled a list of projects building on it.

TON: Ecosystem Summary

- Details

TON and Notcoin are skyrocketing!

As a long-time supporter of the TON ecosystem, we have compiled a list of projects building on it.

An overview of the year-long progress for this major blockchain, in numbers and facts

The TON blockchain platform is hosting a DeFi and data analytics hackathon called Hack-a-