Throughout the crypto market’s evolution, many Layer 1 blockchains rise and fall. Yet, Algorand, launched in 2019, continues to demonstrate steady growth. In this article, analysts from DWF Ventures will highlight its promising developments and what the future holds for the ecosystem.

Introduction

Algorand is a high-performance, Layer 1 blockchain known for its low-cost transactions and scalability. Powered by the Algorand Virtual Machine (AVM), it supports smart contracts coded in Python, making it highly accessible to developers. With tools like AlgoKit, developers can start building applications in minutes.

Recent Developments in Algorand

At the Decipher 2024 conference, several key developments were announced for Algorand. Among them, the most significant is the native support for USD Coin (USDC), enhancing on/off-ramp efficiency and broadening access for users. Other notable developments include:

- Integration with Nansen, providing comprehensive data dashboards for deeper insights into Algorand’s on-chain data.

- Establishing the Humanitarian Council in partnership with United Nations Development Programme (UNDP) and Circle, aimed at improving aid delivery through blockchain technology.

- Collaboration between Pera Wallet and Mastercard, enabling real-world USDC transactions.

Focus on RWA

With all the described developments, it is clear that bridging the gap between Web2 and Web3 is a key focus for Algorand. Real-world assets (RWAs) are an important sector as well, as they bring more liquidity and use cases for users on the chain.

Algorand has partnered with the UK-based regulated crypto exchange Archa to allow the euro-based stablecoin EURD issued by Quantoz to be used on the platform. This brings about enhanced efficiency (settlement, liquidity) and transparency.

Some protocols on Algorand tap into other types of RWAs. For instance, Lofty develops a fractional real estate marketplace, while Meld Gold aims at tokenizing the physical gold’s supply chain.

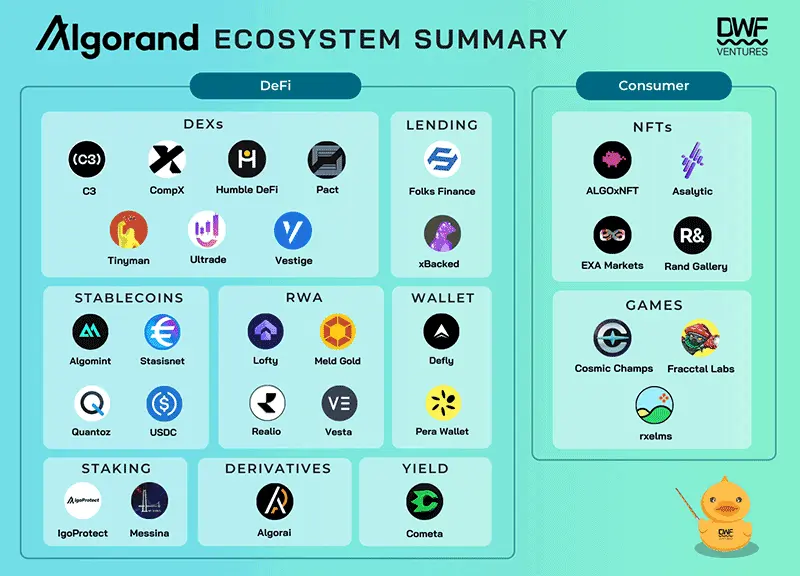

DeFi on Algorand

Although still in its early stages, DeFi activity on Algorand is poised for growth. Folks Finance is set to relaunch its liquid staking token xALGO, with upcoming changes to ALGO tokenomics, which could increase potential yields and attract more liquidity.

Additionally, the Algorand Foundation has introduced a protocol that allows developers to connect seamlessly with multiple wallets using a single integration, improving the decentralized and secure peer-to-peer communication between dapps and users.

Consumer Sector

Algorand is also making strides in the NFT and Web3 gaming spaces. Noteworthy developments include:

- Asalytic, a platform that aggregates NFTs and helps users make informed decisions.

- EXA Market, which recently launched V2 and will initiate a rewards program in collaboration with CoinList.

- Fracctal Labs, a growing Web3 game developer, is preparing to release its game Fracctal Monsters in the Epic Games Store, targeting a broader Web2 audience.

- Rxelms, a cross-chain virtual world built on the Unity engine, launched earlier this year on Algorand.

Conclusion

With its growing partnerships and developments in areas such as DeFi, RWAs, and NFT projects, Algorand shows immense potential. We are excited to support this ecosystem and looks forward to the blockchain's continued growth. If you look for a crypto venture capital to build on Algorand, contact DWF Ventures.