As market activity slows, DWF Ventures has revisited some key narratives from earlier this year. One standout is liquid restaking and liquid restaking tokens (LRT), which continue to generate interest as the space sees ongoing developments.

Here's an overview of the latest trends and insights.

Top LRT Protocols

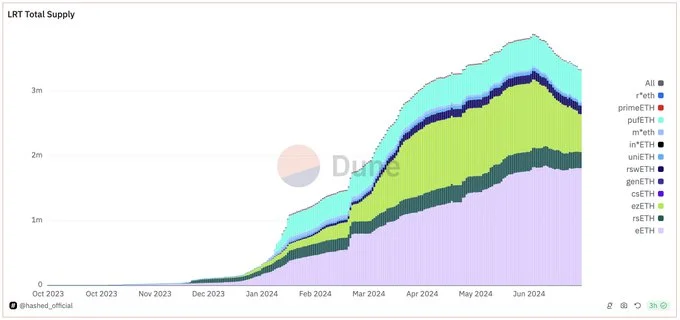

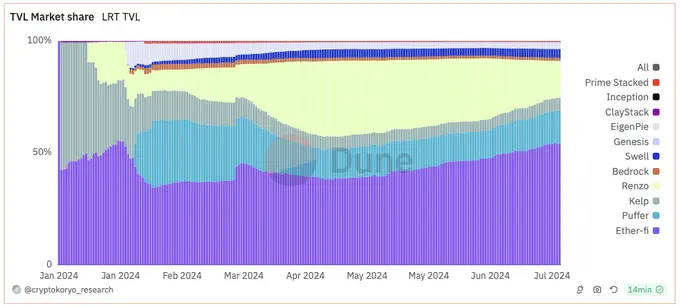

Since our last update back in February, protocols like Etherfi, Puffer Finance, Kelp DAO, and Renzo Protocol remain leaders in the liquid restaking space. The total value locked (TVL) in the market has more than tripled since February 2024, now totaling 3.34 million ETH, equivalent to around $11.3 billion at current prices (excluding LRTs locked in liquidity pools).

Etherfi (ETHFI) vs. Renzo Protocol (REZ)

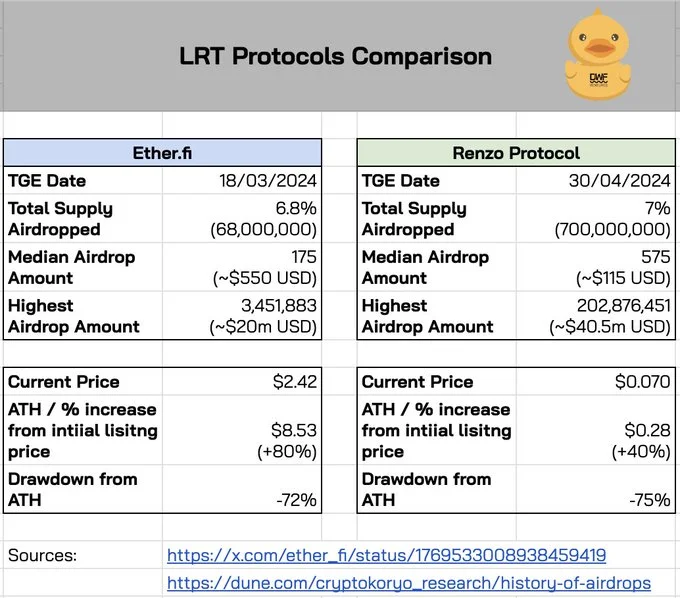

Both Etherfi and Renzo have launched their tokens, ETHFI and REZ, respectively. They have experienced approximately 70% declines from their initial ATHs, likely due to unfavorable market conditions and a lack of sustained user demand.

This raises the question: Are LRTs primarily appealing to airdrop farmers?

In both token generation events (TGEs), a significant portion of tokens was airdropped to the community. Renzo's airdrop disproportionately favored whales, as evidenced by the gap between the largest and median token holders. This likely contributed to increased selling pressure.

How can LRT protocols maintain an edge?

Following Renzo’s airdrop, Etherfi managed to capture a larger share of the liquid restaking market’s TVL. In an increasingly competitive market, attracting liquidity will rely on offering compelling incentives, while maintaining liquidity will require strong team execution and clear communication with the community.

LRT Incentives

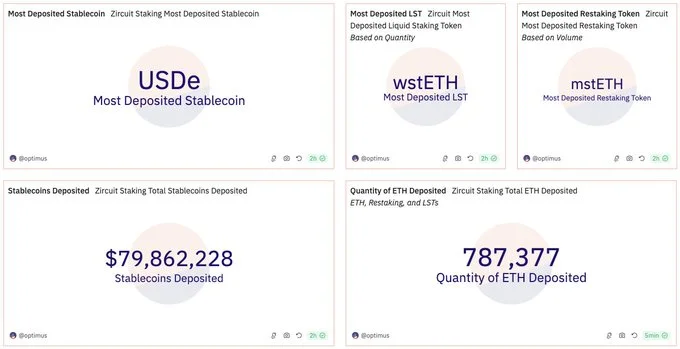

In liquid restaking, economic incentives could include expanding to new chains or creating chain-specific LRTs. Zircuit is poised to be a crucial player, offering three sources of rewards (LRT + EL + Zircuit points) at the minimum. This structure has driven over $400 million in TVL into Eigenpie’s LRT tokens, making it a key contributor.

Chain-Focused LRT

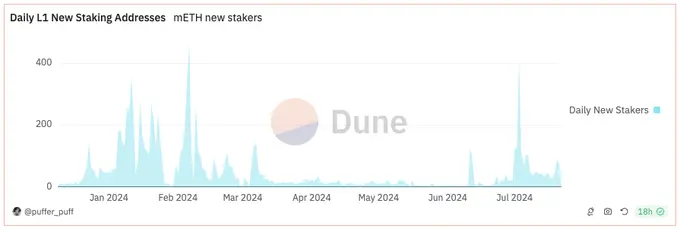

An emerging trend worth noting is the rise of chain-specific LRTs. For example, Mantle introduced cmETH, a chain-focused LRT, through its Metamorphosis campaign.

Users can earn “Powder” by staking mETH, which converts into cmETH, a high-yield liquid staking token that receives multiple reward streams, including:

Since July 1st, the campaign has onboarded over 1,700 new stakers to the Mantle ecosystem. By enabling users to boost “Powder” production with MNT tokens, Mantle creates a flywheel effect, where value is continuously reinvested into the ecosystem and rewards its most loyal users.

New Restaking Players

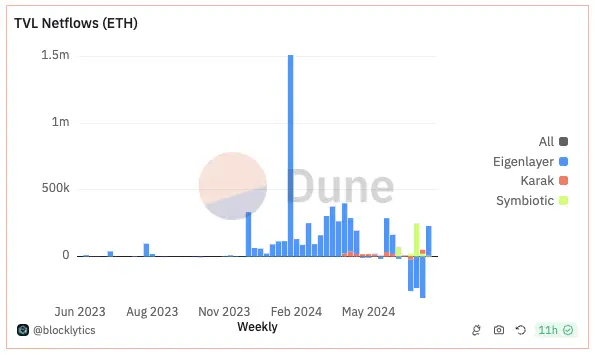

The liquid staking market continues to grow, with new projects like Symbiotic and Karak Network making significant strides. Symbiotic’s TVL has reached $1.28 billion, while Karak Network has accumulated $1.04 billion in TVL.

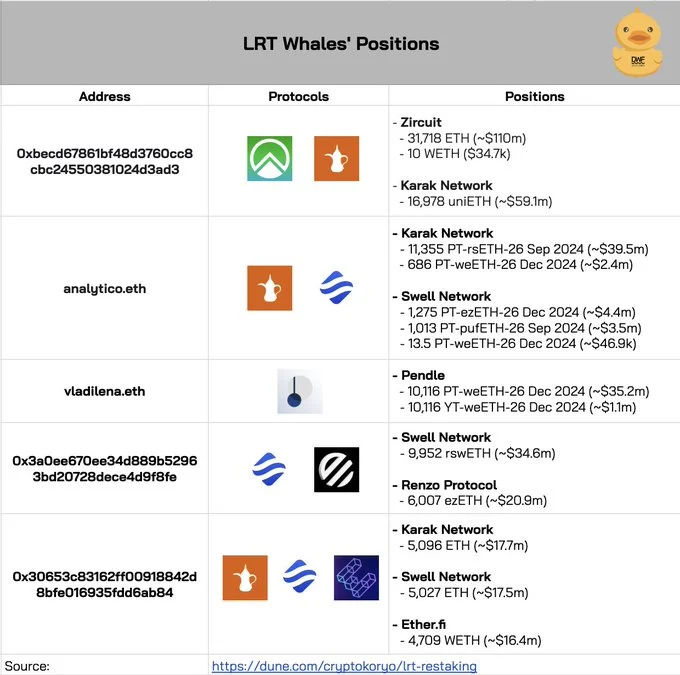

Airdrop Farming

Crypto whales are increasingly turning to tokenless protocols like Karak Network and Swell. Notable yield farmers, including analytico.eth, have also started using Pendle's PT/YT tokens to optimize their capital efficiency in pursuit of rewards. Despite some challenges, the farming opportunities remain abundant.

Overall

Restaking remains a vital sector within the crypto landscape, despite concerns around potential risks. As AVSs continue to grow, they enhance the utilization and yield potential of LRTs, attracting liquidity and encouraging the development of new protocols on top of the LRT infrastructure. If you are building in this space and are searching for a trusted crypto VC partner, don’t hesitate to contact DWF Ventures.