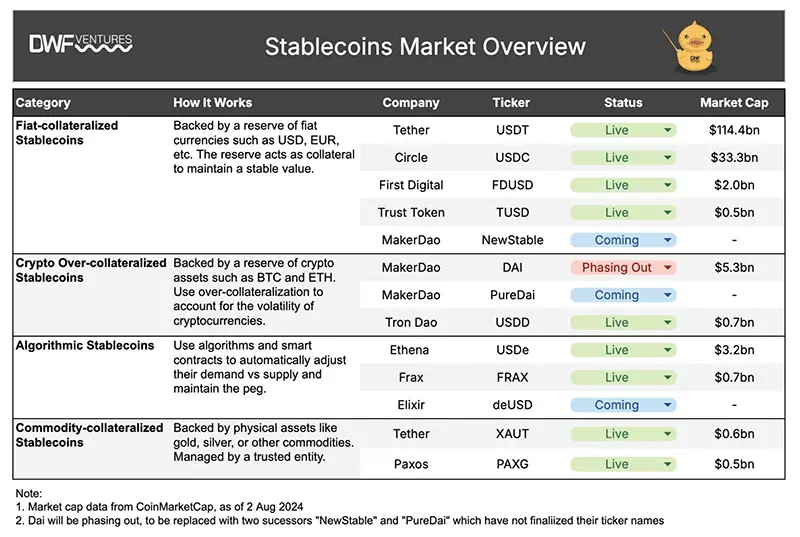

The stablecon market is getting momentum, highlighted by Tether’s recent announcement of a $5.2 billion net profit in just the first half of 2024, and the speculation surrounding Circle’s potential IPO. DWF Ventures conducted a market analysis and made a table to classify stablecoins, explain their distinctions, and highlight the most notable players in the space.

Stablecoins Market Size

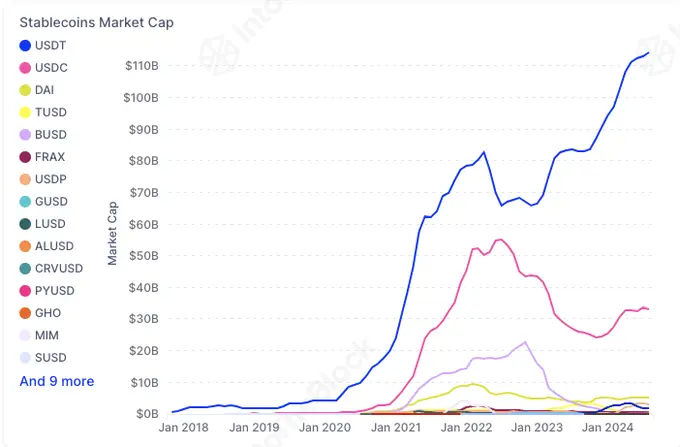

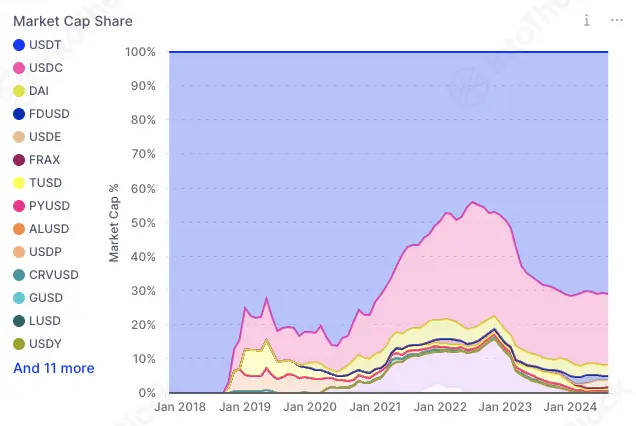

The stablecoin market has experienced significant growth, with total capitalization exceeding $160 billion, an increase of $41 billion since October 2023.

This upward trend reflects the increasing flow of capital into cryptocurrencies, underscoring the critical role stablecoins play as a substitute for “cash” within the digital asset ecosystem.

Tether: Market Leader

Boasting a $114 billion cap, Tether dominates the stablecoin sector, holding nearly 70% of the market share. Although Circle grew rapidly between 2020 and 2021, Tether has outpaced it and other competitors since mid-2022, reclaiming its leading position.

Recently, the company made headlines with an impressive attestation report. It revealed a net profit of $5.2 billion in the first half of 2024, and almost $98 billion worth of U.S. treasuries sitting on its balance sheet, more than Germany. These figures demonstrate their enormous cash-generating capacity.

Types of Stablecoins

Depending on the collateral structure, stablecoins can be classified into several categories:

- fiat-collateralized stablecoins;

- crypto over-collateralized stablecoins;

- algorithmic stablecoins;

- commodity-collateralized stablecoins.

Fiat-Collateralized Stablecoins

The most common and widely used stablecoins are backed 1:1 by traditional fiat currencies such as the U.S. dollar. Key examples include Tether’s USDT, USD Coin (USDC), First Digital USD (FDUSD), and TrueUSD (TUSD). MakerDAO, the platform behind the decentralized stablecoin DAI, plans to launch a new stablecoin, NewStable, aimed at institutional liquidity.

Crypto Over-Collateralized Stablecoins

These stablecoins are backed by reserves of cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), often using over-collateralization to address the price volatility of crypto assets. Examples include USDD and DAI, though DAI is set to be replaced by PureDai.

Algorithmic stablecoins

Algorithmic stablecoins use algorithms and smart contracts to automatically adjust supply and demand to maintain their peg. Notable examples include USDe and FRAX. A new entrant, Elixir, has introduced a “delta-neutral” and “yield-bearing” stablecoin called deUSD.

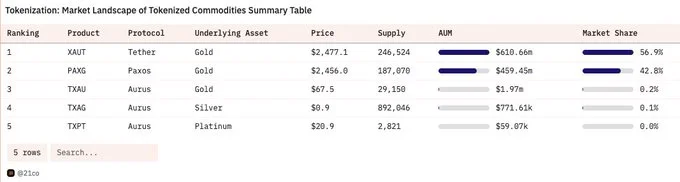

Commodity-Collateralized Stablecoins

Crypto assets backed by physical assets like gold, silver, or other commodities represent a separate kind of stablecoins. The reserve of such stablecoins is usually managed by a trusted entity. Examples include Tether Gold (XAUT) and Pax Gold (PAXG). Even though the adoption has been slower for commodity-collateralized stablecoins, it is steadily increasing.

What's Next?

Stablecoins are a critical driver of growth in the broader cryptocurrency market, and their expansion is expected to continue. And soon, there will be one more player in this field. DWF Labs’s Managing Partner, Andrey Grachev, recently hinted at the company’s upcoming project: a CeDeFi synthetic stablecoin that will combine yield generation with risk management and regulatory compliance. With this move, our company continues the road to becoming a global web3 financial institution.