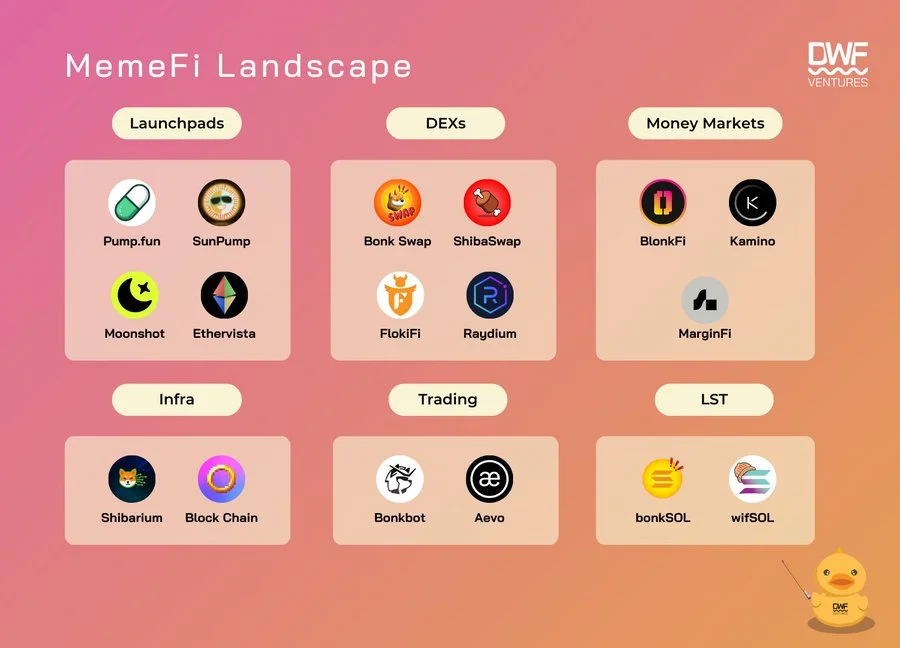

Memecoins are generally integrated with DeFi. Many niches, such as DEX and launchpads, are occupied by well-known names and assets, as seen on our infographics below:

Still, one particular use case, yield generation and leverage, has been relatively unexplored yet possesses vast potential.

While Solana leads the memecoin race, one project from its ecosystem that expands into this sphere is BlonkFi, a money market protocol where memecoins can be used as collateral to borrow stablecoins. We put BlonkFi to the spotlight in this article to tell you about its core features and benefits.

BlonkFi’s Pre-Seed Round and Testnet Launch

BlonkFi is a new protocol on Solana focused on serving the memecoin market, which completed its pre-seed investment round at the end of July, led by crypto VC firms UOB Venture Management and Signum Capital, with additional participation from DWF Labs and other funds.

The protocol plans to launch in the testnet at the end of September 2024, allowing users to try out the platform and explore its features. The testnet will allegedly support several crypto assets, including WIF, BONK, and MOTHER.

Memecoin Borrowing Mechanism in BlonkFi

BlonkFi is a money market protocol, serving as a tool for collateralisation of memecoins. Users can deposit their memecoins to earn yield, or choose to borrow stables and potentially ape in another token without selling their initial position, which is currently not possible with respect to memecoins in any other dapp.

High price volatility of memecoins is the main issue BlonkFi had to solve to make memecoins useful as collateral. Thus, the developers introduced robust risk management through the Moon and Throttle Modules, to help borrowers mitigate volatility and protect them against downside risks.

BlonkFi’s Moon Module Explained

Moon Module aims to reduce users' losses in drawdowns, enabling the protocol to retain higher LTV in comparison to competitors. BlonkFi is also the first to introduce direct partnerships with the developers of memecoins, reducing users' liquidations by exercising options in time.

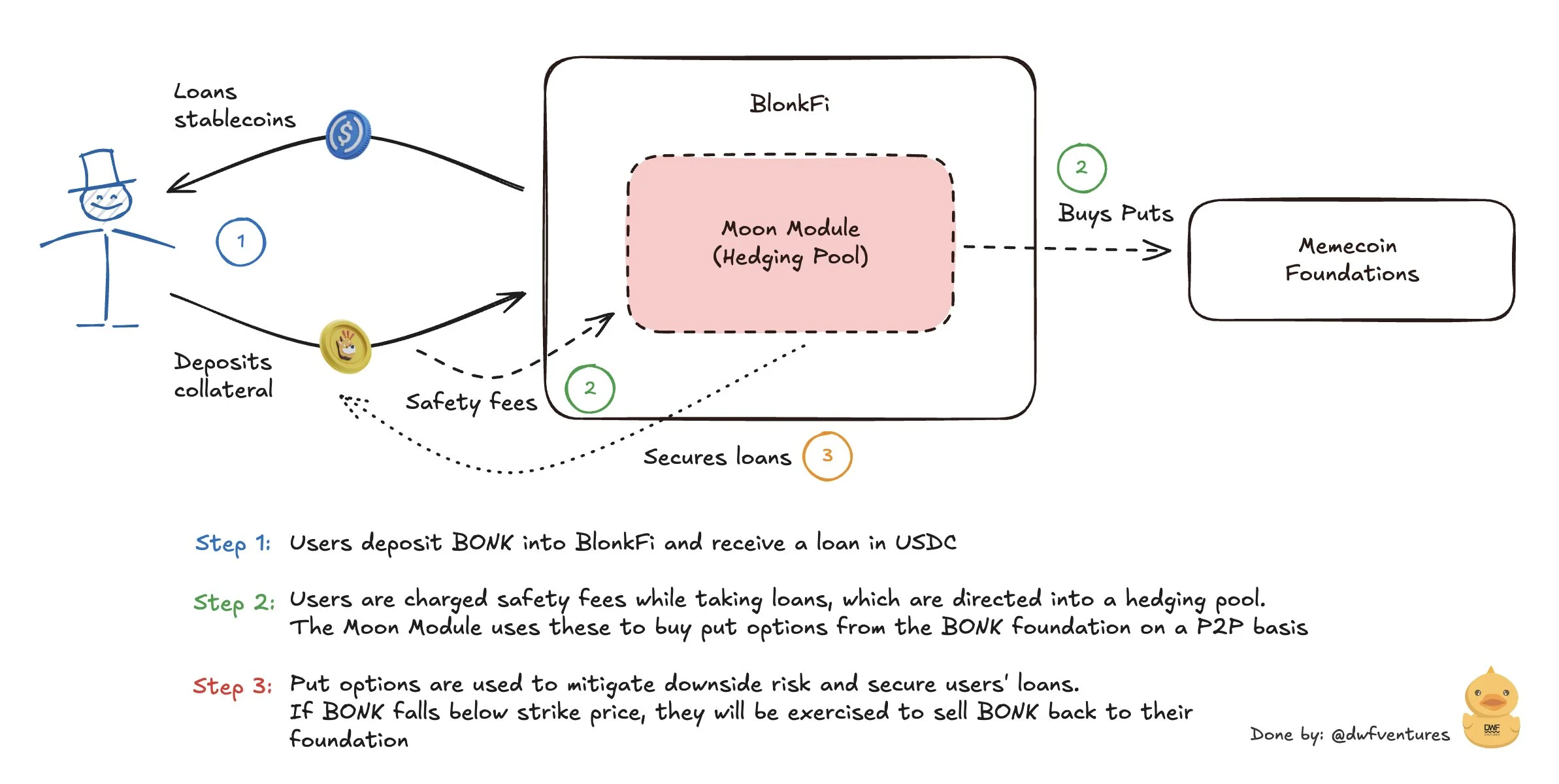

Here is a simple explanation of how the Moon Module works:

- Users provide a meme token BONK as collateral in BlonkFi in exchange for loans denominated in stablecoins (USDC).

- As they take out loans, they are required to pay safety fees. These fees are then directed to a Moon Module, which acts as a hedging pool.

- The Moon Module uses the collected fees to purchase put options from the BONK foundation on a P2P basis. A put option gives the right to sell BONK at a predetermined price if the market price drops below a certain level.

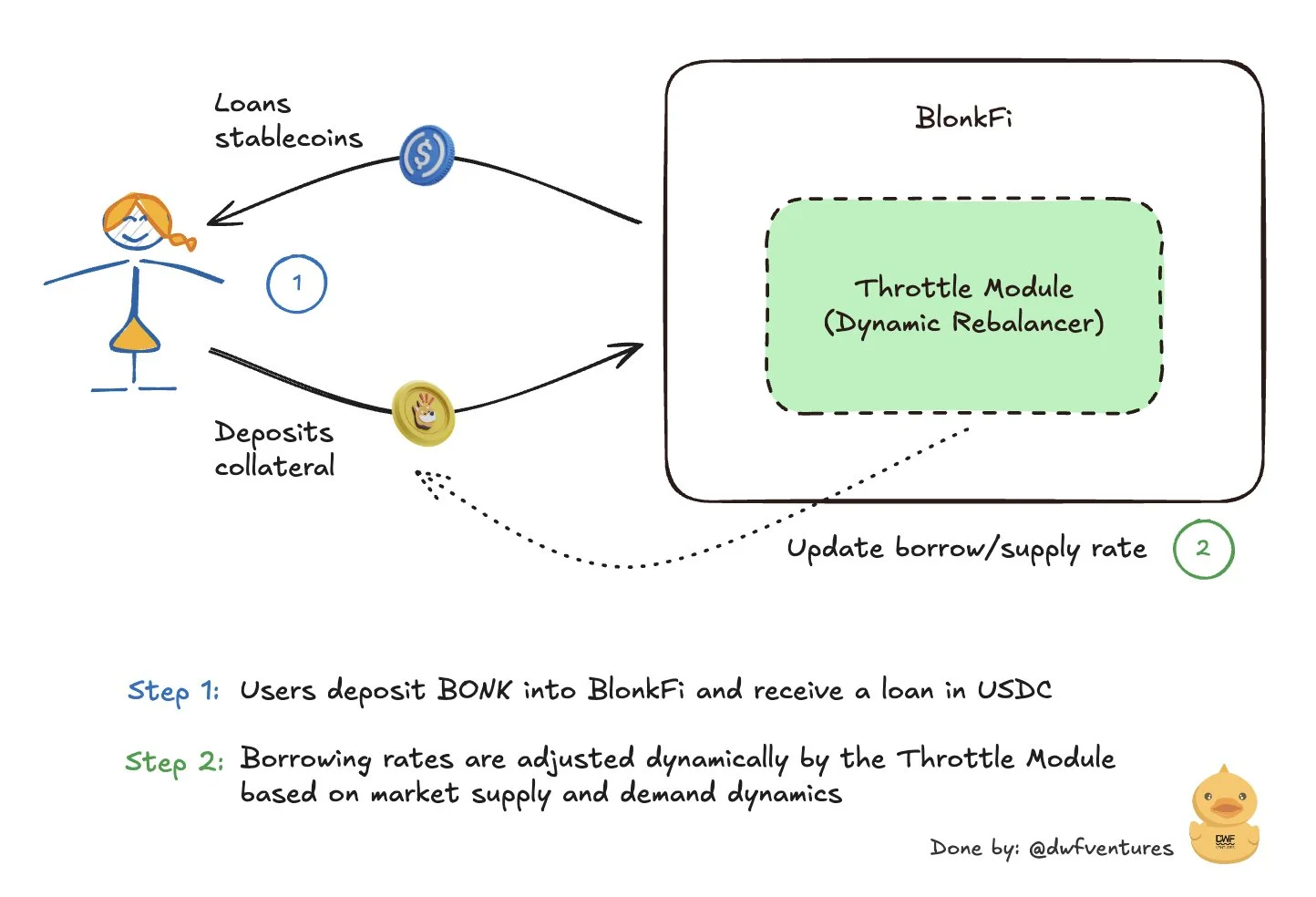

How Does BlonkFi's Throttle Module Work?

Alongside the Moon Module, BlonkFi operates the Throttle Module, needed for adjusting borrowing and supply rates in real-time in response to market conditions. Essentially, its main job is to update the exchange rate between the memecoin provided as collateral and a borrowed stablecoin.

Liquidation Process

When it comes to a money market protocol such as BlonkFi, one of the main concerns is how the liquidation works, what the triggering conditions are, and what happens after the liquidation.

In BlonkFi, the liquidation process involves multiple stages. Here is a short summary:

- Monitoring collateral: The platform continuously tracks the value of the borrower's collateral using real-time price feeds from the Throttle Module and checks the Loan-to-Value (LTV) ratio against set thresholds.

- Liquidation triggering: If the collateral’s value drops, making the LTV ratio too high, a liquidation event starts. The borrower is notified, and BlonkFi sells their collateral, minimising market impact. If needed, the Moon Module may exercise or sell options to cover any shortfall.

- Loan repayment: Proceeds from the collateral sale go toward repaying the crypto loan, with applicable fees deducted. Any leftover funds are returned to the borrower.

- Post-liquidation: If the collateral sale doesn’t cover the full loan, BlonkFi absorbs the loss or follows additional risk management protocols.

Such a common yet practical approach to risk management balances protecting the protocol’s crypto assets while giving borrowers a chance to mitigate potential losses.

Overall

BlonkFi promises to become the first Web3 project to make memecoins a sufficient collateral for stablecoin loans, if it succeeds in managing the high volatility of these kinds of crypto assets.

Being the project’s supporters, we look forward to the launch of BlonkFi as we believe this protocol has the potential to bring a new paradigm of how memecoins can be utilised in DeFi, boosting the overall growth of the sector.

If you build in the MemeFi space and feel like we could collaborate, contact DWF Ventures directly.