Our team participated in the Token2049 crypto conference in Singapore, and also organized a side-event, VC Pitch Day, hosted together with prominent crypto venture capital firms. In this article, we bring together all the key narratives and topics of discussed at the latest Token2049.

Market Outlook

Overall Sentiment

With the US Federal Reserve cutting interest rate just before the opening of Token2049 by 50 basis points (0.5%) for the first time since 2020, and upcoming presidential elections, overall vibes towards the end of the year were positive. Although there were over 700 side events, the turnout had been positive: many events happened to be oversubscribed, showing positive sentiment.

Web3 Projects

Many are pushing back launch timelines, with most teams aiming for launching either in Q4 2024 or Q1 2025, anticipating a better market environment.

Crypto VC

While a big portion of crypto venture capital funds are still searching for investment opportunities, most of them are not as active. In our opinion, it can be attributed to the perceived lack of fresh ideas. Some VCs are also pivoting to include more liquid crypto investment strategies or raise a new fund.

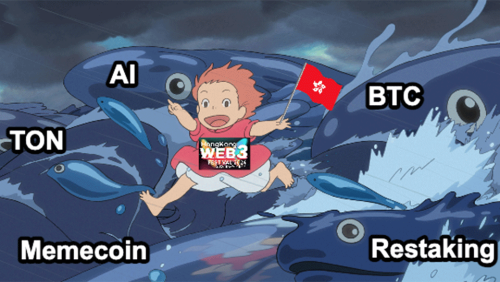

Crypto Narratives

AI x Crypto

Many blockchain projects work in the direction of creating an economic layer for either computations or GPU usage. Another trend is proposing unique use cases with AI agents.

Bitcoin Ecosystem

While $FBTC and $cbBTC that we covered in the article about the wrapped BTC market continue to bring value to DeFi, several projects are also working on bringing programmability and distribution to Bitcoin utilising the Ethereum virtual machine (EVM) or Solana virtual machine (SVM).

MEV and Pre-Confirmations

MEV and pre-confirmations remain a major topic, especially within the Ethereum ecosystem, as we witnessed at the EthCC conference in July 2024. Judging by discussions at Token2049, we can conclude that these solutions will become the norm, returning more value back to app developers and users. The infrastructure around pre-confirmations will give a strong boost to user experience in dapps.

Consumer Applications

From the success of prediction markets to memecoin launchpads, we observe more relatable and fun use cases specifically on utilising intellectual property, which has tremendous potential in drawing non-crypto native audiences to the web3 space.

Battle of Blockchain Ecosystems

Cutting to the chase, the most anticipated crypto launches going forward include Berachain, Monad and MegaETH, all of which have established a strong community and had a good presence in the conference’s discourse throughout the week.

Sonic could be a dark horse heading into the fourth quarter, offering huge incentive programs for deploying dapps on their L1 EVM blockchain. This can potentially spark a DeFi rerun, commenced by the Sonic’s co-founder, Andre Cronje.

In the meantime, Hyperliquid has established itself as the dominant perpetual DEX, and has recently sounded plans to emerge as an L1. Many dapps are already building on it, and the community is led by Hypurr Collective.

Solana still has significant mindshare amidst these new chains, and it, without any doubt, boasts one of the strongest builder communities, Superteam, and dynamic crypto startup accelerators like Colosseum. One of the recent developments in this ecosystem includes the rise of liquid restaking tokens (LRT).

Among other blockchains, whose names came up frequently at Token2049, were TON and Sui. The reason may be their increased on-site visibility: both blockchains hosted several events for web3 builders during the conference that attracted many participants, promising an elevated activity in the future. About a month ago, we drew the prospects for TON, explaining why this network could be the “sleeping dragon” of the crypto industry.

Crypto Community in Singapore

While Singapore has always been the right place for financial institutions and VC funds, local communities, such as SG Builders, become more and more visible. Growing, these communities keep on making Singapore a centre of the crypto market activity in the South-East Asia region.

This trend is underlined by the recent announcement of OTC crypto options trading and structured notes for institutional clients from Singapore's largest bank, DBS.

Singapore has also become a place for another real-world use case for blockchain, with TADA and TON forging a partnership to launch a mini-app for booking rides on-chain, which enhances convenience and, ultimately, improves user experience.

Overall

We believe that Token2049 has become yet another proof of a growing interest towards blockchain, web3 and crypto, specifically in the APAC region. There are many tailwinds for the crypto industry, and we are constantly looking to support builders pioneering growth in the space. If you are looking for a crypto VC partner, reach out to DWF Ventures.