The price of the TAO token has surged by over 60% in the past week, as attention shifts back to the AI x Crypto sector. Will TAO remain the top AI coin this cycle, or is it just a meme?

To understand its potential, let’s explore the architectural design of Opentensor, its innovative subnet utilities, key challenges, and the potential impact of the upcoming dTAO token.

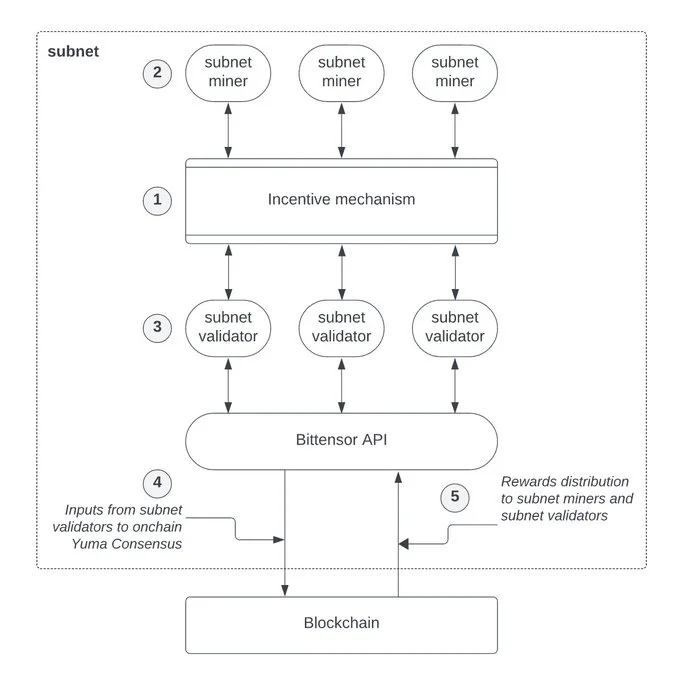

Opentensor Architecture

TAO serves as the governance token for Opentensor, a framework working on top of the Bittensor blockchain. Opentensor strives for creating an AI-focused blockchain network comprised of multiple “subnets,” tailored for specific AI applications.

User Roles

In the Opentensor ecosystem, participants fall into three key groups: miners, validators, and owners. Each of them has a distinct role and responsibilities:

- Miners are usually experts, such as machine learning (ML) practitioners, who join specific subnets to provide high-quality predictions and AI models. By delivering valuable outputs to clients on the network, miners earn TAO as a reward, aligning their expertise with the demands of AI and data-driven products within the subnet.

- Validators act as intermediaries, connecting products of miners with end-users, businesses, or app developers. By facilitating these connections, validators help generate revenue for the network and earn TAO in return.

- Owners are responsible for the establishment and management of subnets. They create the infrastructure and environment needed for both miners and validators to operate productively. By facilitating optimal conditions for participants, owners earn TAO, reflecting their role in sustaining and expanding the Opentensor network.

Consensus Mechanism

Opentensor operates through a Proof-of-Stake (PoS) consensus where miners and validators are rewarded in TAO crypto based on the completion of tasks within each subnet. The rewards structure is regulated by the Yuma Consensus, which determines emissions by evaluating staked amounts and subnet weights. This approach positions Opentensor as a decentralised platform for AI apps, from natural language processing (NLP) to complex machine learning (ML) tasks.

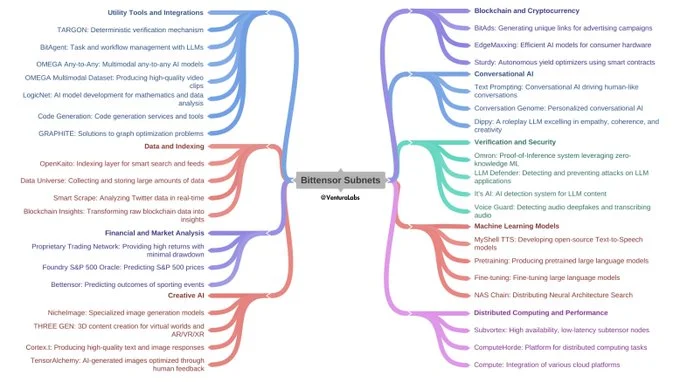

Subnets Overview

Opentensor currently operates around 46 subnets, each focused on a distinct function within the ecosystem. These subnets offer various capabilities:

- Vision (SN19). Specialises in handling inference tasks for image and text processing, making it ideal for visual AI applications.

- Pretraining (SN9). Focuses on generating high-quality AI models, critical for applications that require extensive model training.

- Text Prompting (SN1). Powers conversational AI, enabling the development of advanced chatbots and dialogue systems.

Other noteworthy subnets include:

- Kaito AI (SN5). Trains text-embedding models for sophisticated NLP tasks, a valuable asset for applications that rely on understanding and generating human language.

- Taoshi (SN8). Focuses on traders by offering AI-driven yield-generating strategies, appealing to those interested in combining finance and AI.

These subnets combine in a full-fledged decentralised network, catering to a wide array of modern needs for AI.

Challenges

While Opentensor’s multi-subnet approach and TAO’s role in incentivising participation have driven interest, the network still faces several challenges:

- Barrier to entry. The cost of registering a subnet is high, standing at around $500,000. It restricts participation to well-capitalised entities, limiting accessibility for smaller developers.

- Validation collusion. Opentensor currently caps the number of validators at 64, and a significant portion of stake resides with top validators. This concentration of power raises concerns over collusion, as top validators could influence rewards distribution and subnet incentives.

- Quality control issues. The process of determining the quality of outputs, where validators select the “best” results from miners, lacks transparency. This can lead to inconsistent quality control, discouraging potential contributors.

These issues underscore the need for refined governance and accessibility improvements within Opentensor to ensure long-term sustainability and decentralised operation.

TAO Token Analysis

TAO supply has over 79% (approximately 5.8 million tokens) locked in validator pools, including TAO used as registration collateral for subnet access. However, inflation remains a concern: 7,200 TAO (about $3.9 million) enter circulation daily. While about 15% of emission gets “recycled” as future emissions, the inflation rate could potentially dilute the crypto asset’s value.

Looking ahead, the first halving event scheduled for November 2025 will cut emission by 50%. While this halving could lower inflationary pressure, it may also reduce rewards, making Opentensor less attractive for validators. To counter this, Bittensor developers are introducing Dynamic TAO (dTAO), another token designed to stimulate subnet activity and provide additional incentives for validators.

Is dTAO a Potential Catalyst?

The issuance of dTAO is intended to decentralise the emissions process: dTAO enables all TAO holders to delegate their tokens to specific subnets, earning subnet tokens in return. As demand for certain subnets grows, so does the value of their respective subnet tokens. This offers users a way to directly benefit from subnet success.

Key advantages of dTAO include:

- Decentralised emission. dTAO shifts the emissions process from validators to a broader base of TAO holders, enhancing the decentralisation of rewards distribution.

- Enhanced demand for TAO. By enabling more speculative engagement, dTAO has the potential to increase demand for TAO, as more users participate in subnet growth.

Set for release by the end of this year, dTAO could prove pivotal in addressing Opentensor’s current challenges while fostering a more inclusive ecosystem.

Overall

Although Opentensor has still a long way to go before becoming mainstream, the AI Crypto narrative is on the rise. The demand for AI solutions is growing exponentially, and with it the need for decentralised infrastructure, promised by cryptocurrencies and blockchain.

The recent soaring of TAO price reflects the growing interest in Opentensor, However, challenges such as high entry costs, validator concentration, and opaque quality control threaten Opentensor’s decentralised vision. Concerns about inflation persist, though the upcoming 2025 halving and introduction of dTAO aim to decentralise emissions and incentivise subnet growth.

If you are building a subnet or another application within Opentensor, don’t hesitate to contact DWF Ventures about partnership opportunities.