DWF Ventures breaks down the two projects that plan to bridge TradFi and DeFi

The first week of February 2025 was marked by the hype about the Berachain (BERA) airdrop claim, started in the beginning of February, and the pain on memecoins and AI agents. It was easy to overlook a significant development in the realm of real-world assets (RWAs): Ondo Finance’s announcement of the Ondo Chain during their summit.

DWF Ventures explores how Ondo Chain, along with another emerging project, Plume Network, can shake up the entire RWA landscape, sending waves across the broader crypto market.

Ondo Chain and Its Impact on RWAs

Ondo Chain is a Layer 1 proof-of-stake blockchain, designed to build a bridge between traditional finance and decentralised finance (DeFi). By integrating the openness of public blockchains with the compliance and security features of permissioned networks, Ondo Chain aims to facilitate the large-scale tokenisation of RWAs, thereby accelerating the creation of institutional-grade financial markets on-chain.

Wall Street 2.0: A New Financial Paradigm

The concept of ‘Wall Street 2.0’ encapsulates Ondo’s vision of evolving financial markets through blockchain integration, differentiating itself by emphasising institutional-grade compliance, seamless interoperability with existing financial systems, and enhanced transparency in asset tokenisation.

This approach seeks to provide seamless access to a diverse range of assets, real-time settlement, and automated compliance, all while reducing reliance on intermediaries. The anticipated benefits include enhanced transparency, increased flexibility, and lowered barriers to entry for all participants.

Ondo Global Markets: Bridging Traditional and Decentralised Finance

A pivotal component of the ‘Wall Street 2.0’ vision is Ondo Global Markets, also unveiled during the crypto conference in the beginning of February 2025. It is a platform dedicated to the tokenisation of publicly traded securities such as stocks, bonds, and exchange-traded funds (ETFs).

The platform is designed to offer features like global, round-the-clock access, instant minting and redemptions, margin trading, and high transferability of assets. By bringing these traditional financial instruments on-chain, Ondo aims to merge the deep liquidity and investor protections of traditional finance with the innovation and openness of DeFi.

Ondo Global Markets is structured to serve both institutional and retail investors, offering a regulated and transparent environment for RWA tokenisation. The platform provides access to yield-bearing assets, allowing participants to engage in automated DeFi activities while adhering to compliance standards. Additionally, Ondo’s partnerships with major financial institutions help ensure that tokenised assets are backed by robust legal frameworks.

Addressing Challenges in Integrating TradFi and DeFi

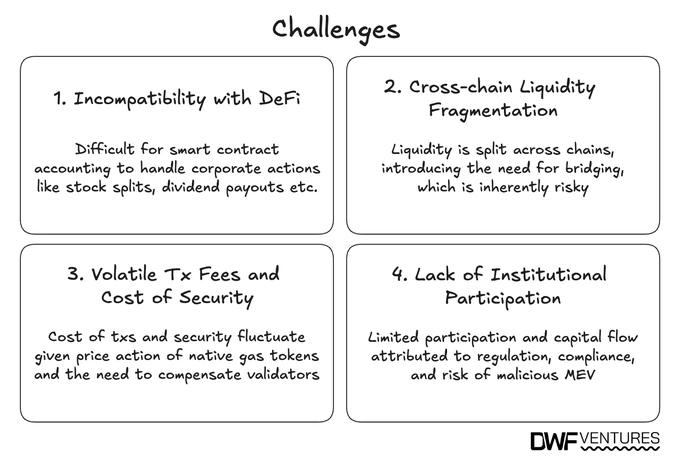

In developing Ondo Global Markets, the team identified key challenges in uniting traditional finance (TradFi) with decentralised finance:

- Inherent incompatibility with DeFi. Traditional financial instruments often struggle with smart contract accounting, making it difficult to handle corporate actions like stock splits and dividend payouts on-chain.

- Cross-chain liquidity fragmentation. The division of crypto liquidity across multiple blockchains creates a reliance on bridging solutions, which introduces security risks.

- Volatile transaction fees and security costs. In blockchain networks, transaction fees inevitably fluctuate due to market and other external conditions, while built-in network rewards for validators pose challenges for maintaining a stable ecosystem.

- Lack of institutional involvement. Regulatory uncertainty, compliance requirements, and risks such as malicious MEV deter institutions from fully engaging in DeFi.

These challenges highlighted the need for a new blockhain-based solution, leading to the creation of Ondo Chain.

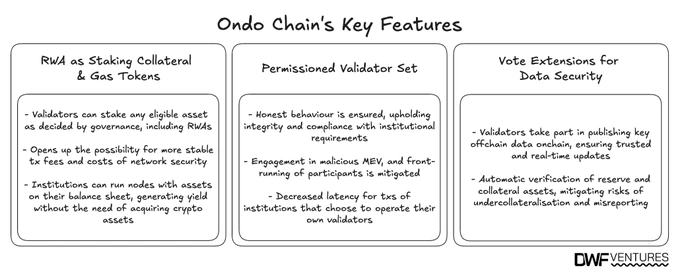

Key Features of Ondo Chain

Ondo Chain blends the strengths of private, permissioned networks with public, permissionless blockchains. It is designed in collaboration with traditional financial institutions like Franklin Templeton Investments and consulting firms such as McKinsey & Company. Key features include:

- RWAs as staking collateral and gas tokens: In Ondo Chain, validators can stake any eligible asset as decided by governance, including RWAs. It opens up the possibility for more stable transaction fees and costs of network security. Institutions gain the ability to run nodes with assets on their balance sheet, generating yield without the need of acquiring crypto.

- Permissioned validator set: Ondo Chain ensures validators’ honest behaviour by upholding integrity and compliance with institutional requirements, mitigating any engagement in malicious Maximal Extractable Value (MEV) and front-running of consensus participants. As an incentive, the blockchain provides decreased latency for transactions of institutions that choose to operate their own nodes.

- Vote extensions for data security: Validators in Ondo Chain take part in publishing key off-chain data on-chain, ensuring trusted and real-time updates. The blockchain protocol automatically verifies reserves and collateral assets to reduce risks of undercollateralisation and misreporting.

These features enable Ondo Chain to offer faster transaction finality, lower latency, and a stronger bridge between traditional financial networks and DeFi ecosystems.

Plume Network: The Buy-Side of RWAs

Ondo Chain is not the only RWA-focused Layer 1 blockchain: Plume Network, already in its testnet phase, is another key player in the space of tokenising real-world assets. Instead of competing with one another, Ondo Chain and Plume Network have decided to establish a symbiotic relationship.

Whereas Ondo’s ‘Wall Street 2.0’ strategy focuses on bringing RWAs on-chain for institutional and retail investors, Plume Network positions itself as ‘Robinhood 2.0,’ emphasising a community-first platform that drives demand for these tokenised assets.

Following this approach, Plume Network aims to enhance retail participation in RWAs by offering a user-friendly interface, diversified asset access, and governance features that empower users in decision-making processes. By acting as the buy-side infrastructure, Plume complements Ondo’s essentially sell-side tokenisation model.

Future Outlook: Adoption and Innovation

Together, Ondo Chain and Plume Network create a well-defined ecosystem for the on-chain RWA sector to thrive. The combined efforts of these two platforms are expected to:

- Improve the liquidity and accessibility of RWAs for both retail and institutional investors.

- Foster the emergence of new yield-generating products within the DeFi landscape.

- Enhance user experience (UX) through better integration with wallets and financial applications, making the onboarding process seamless for new crypto entrants.

With increasing interest in RWA tokenisation and institutional participation in DeFi, the partnership between Ondo Chain and Plume Network signifies a transformative step in financial markets. As these networks evolve, they are set to play a crucial role in bridging traditional and digital finance, creating opportunity for a more inclusive and efficient financial ecosystem.

We eagerly at DWF Ventures await further development from both projects. If you are building a project within the RWA sector, reach out to us to discuss partnership opportunities.