Managing Partner at DWF Labs, Andrei Grachev, took the stage at the TOKEN2049 crypto conference in Dubai on 30 April 2025 to talk about the current issues of the crypto market, how DWF Labs navigates them, and why he views perspectives of cryptocurrencies with optimism. Read the summary of his speech below.

Crypto Market Now: Hard Times Create Good Times

Grachev started by stating that the crypto market landscape is completely different from that of a few years ago, and the pace of change has increased.

In recent market cycles, big crypto projects like Ethereum, supported by funding from major financial firms, managed to grow. However, recently, they have shown poor market performance, especially large-cap tokens. This creates an opportunity to invest in emerging and innovative protocols.

‘Back in 2017, Bitcoin was fighting with banks for recognition. Now, it is adopted by banks and even governments,’ stated Andrei Grachev.

In his view, BTC is no longer merely a cryptocurrency. Instead, it now encompasses various Bitcoin-based instruments from traditional finance such as ETFs.

One big issue in the current crypto market is the lack of fresh blood: liquidity has dried up due to the ongoing tight monetary policy. The second reason is the increased popularity of perpetual futures: dominating the crypto derivatives space, they amplify the downturn trend. Finally, there is fierce competition between blockchain ecosystems, which damages the overall market performance.

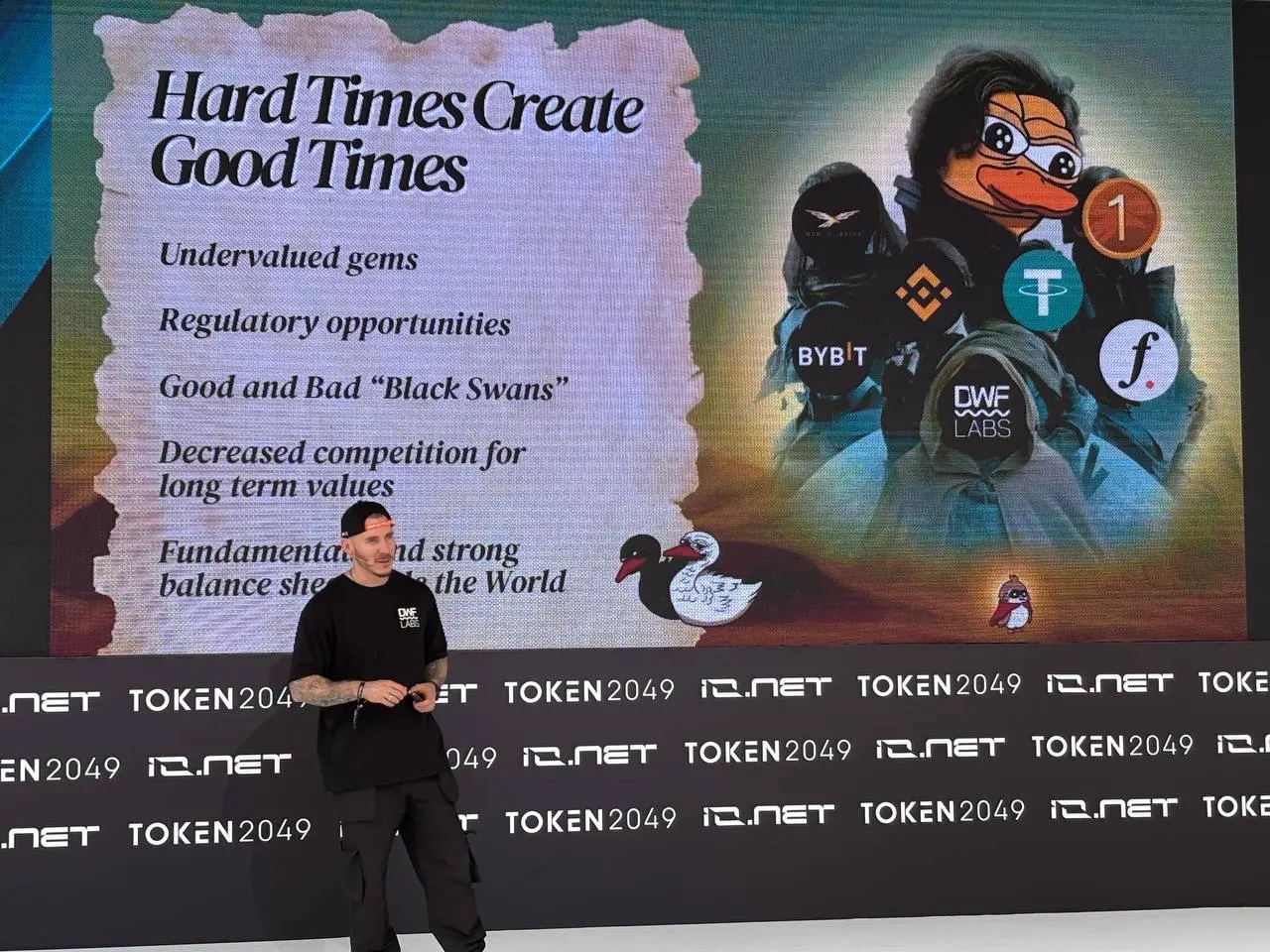

Andrei Grachev on the TOKEN2049 stage during his speech ‘Changing the Crypto World Order’. Source: DWF Labs

But hard times create good times, especially for those with capital and connections. While some are fighting for survival, it makes it easier to find undervalued tokens, hidden gems, on the open market. Just a week before the TOKEN2049 conference, Andrei Grachev had an interview with a leading newspaper about the DWF Labs’s investment in World Liberty Finance. Talking to the journalist, Grachev compared this move with investment in TON DWF Labs made in 2022: when everyone was doubting the project’s viability, DWF Labs saw its high potential, and it paid off.

In addition to that, global regulation of cryptocurrencies has improved, bringing more long-term certainty. Overall, market fundamentals are strong.

Plan to Succeed in Crypto in 2025

With all these circumstances, how to succeed in the crypto market in 2025? Andrei Grachev outlined the strategy DWF Labs will follow.

First, the company will invest in altcoins more actively throughout 2025, focusing on those not only with technology but also a clear appeal to users, as it is not only the product that matters:

‘There are plenty of dead blockchain projects that had a great product, technology. What also matters is execution: you can build something very simple that people will use or enjoy, and if you execute it nicely, it works.’

DWF Labs has launched a $250 million Liquid Fund to provide funding to promising mid and large-cap crypto projects. A large portion of this amount has already been allocated:

‘Through our joint project with partners, we have begun buying tokens on the spot market. Our goal is to build a portfolio totalling about $3 billion deployed on the secondary market this year,’ said Grachev.

The second part of the plan is to create a fixed income layer for the crypto market using Falcon Finance, a yield-bearing synthetic dollar protocol:

‘We do believe that this crypto market is an upgraded replication of traditional markets that have a lot of fixed-income products. There are a few fixed-income products in crypto right now, but they rely on some single strategy such as funding rate arbitrage of Ethereum or Bitcoin short positions. It is not risk-free, and it is not scalable. Falcon Finance will let holders of altcoins, stablecoins and blue-chip assets such as Bitcoin use their funds to generate sustainable yield. The DWF Labs’s ultimate goal is to bring financial and savings freedom to everyone within a single ecosystem that is currently being built around DWF Labs.’

Why DWF Labs Remains Optimistic About Crypto

The final part of Andrei Grachev’s speech was dedicated to explaining why DWF Labs is optimistic about the prospects of crypto for 2025.

He said everything indicates the next round of Federal funds rate cuts, along with a new quantitative easing programme, which will ‘push new money to the market.’

‘It will happen sooner or later. It can happen today, it can happen in three or six months, but it will happen. If you look at historical data, you will see that cryptocurrency prices have only ever gone up. More dollars on the market, people start buying,’ explained Grachev.

This new capital injected into the market will send Bitcoin to a new all-time high (ATH), as it will be a popular investment among large financial institutions.

Aside from that, the blockchain industry will see a further development of payment and fixed income assets, such as tokenised bonds and treasury bills, real estate, and other real-world assets (RWAs). Grachev underscored that, although for now, the secondary market for RWAs is in the early stages, its maturation is inevitable—this is why DWF Labs actively invests in this sector of the crypto market.

Finally, the crypto market will be driven by the deepening fragmentation of the global economy. Various regions and economic alliances are already creating several major regulatory frameworks for different industries, including crypto. According to Grachev, finding a way to work with all of the markets will give a crypto company a strong competitive edge.

Andrei Grachev on the TOKEN2049 stage during his speech ‘Changing the Crypto World Order’. Source: DWF Labs