Market Making vs. Liquidity Provisioning in Crypto: What Is the Difference?

October 7, 2024

Liquidity is the engine that powers all financial markets. Yet even seasoned professionals sometimes conflate two key concepts: market making and liquidity provisioning. Though they overlap, as both involve committing capital to facilitate trades, their actual mechanics, incentives, and risk profiles diverge substantially. DWF Labs unpacks these two roles.

Roles of TradFi Market Makers and Liquidity Providers in Crypto

In equity, fixed income, or foreign-exchange platforms market makers typically serve as broker-dealers (firms licensed for selling and buying securities) or specialised trading firms. They are tasked with providing two-sided quotes, continuously posting both bid and ask prices around the prevailing market level.

By absorbing incoming buy or sell orders, TradFi market makers narrow bid-ask spreads, give counterparties reliable execution, and stabilise short-term price fluctuations. Profit in market making arises primarily from capturing the spread, though sophisticated risk-management systems are essential to mitigate inventory imbalances and adverse selection when informed traders act against them.

Liquidity providers commit capital more passively to either order books or dark pools, often under bespoke agreements with exchanges or institutional clients. Rather than continuously quoting, they agree to provide depth at predetermined price levels or under specific rebate or fee schedules. Liquidity providers get returns from a combination of fixed commissions, spread-sharing, or volume rebates, often under bespoke agreements.

They’re less about active order-management and more about guaranteeing a certain level of available liquidity. During periods of market-wide stress, liquidity providers can adjust capital to balance earning opportunities against balance-sheet and regulatory constraints.

In essence, market makers ‘make’ the market by continuously updating prices and taking the other side of trades, while liquidity providers underwrite blocks of liquidity via negotiated arrangements, earning fees by guaranteeing depth rather than by frequently posting and adjusting individual orders.

Notably, centralised market makers and liquidity providers on the crypto market employ the same advanced strategies—algorithmic quoting, inventory management, and exchange rebate programs—as their counterparts in equities, foreign exchange, and fixed-income markets.

From Wall Street Order to On-Chain Trading: A Professionalised Crypto Landscape

In the early days of crypto trading, liquidity was fragmented, shallow and insufficient with the exception of 10-20 most traded digital assets. Mostly presented by centralised exchanges (CEX), trading platforms and P2P services such as LocalBitcoins and Paxful, the market was driven by retail participation.

Dating to early projects such as EtherDelta, an innovative space of decentralised finance (DeFi), which brought smart contracts to trading operation, has only started gaining traction since around 2018, with the emergence of Uniswap, the first decentralised exchange (DEX) powered by an automated market maker (AMM), MakerDAO, which remains the largest algorithmic stablecoin project to date, and Compound, the first lending protocol that managed to establish a viable liquidity farming model.

Over time, however, retail ‘momentum’ was surpassed by professional financial firms and institutions. A handful of professional trading firms have emerged as dominant liquidity engines across centralised and (increasingly) decentralised domains of crypto.

Nowadays, market makers of cryptocurrencies are responsible for deploying low-latency, algorithmic strategies on CEXs like Binance, Bybit, Coinbase, and Kraken. They place staggered limit orders (numerous limit orders placed for one token at various price levels), dynamically adjusting prices across hundreds of trading pairs, capturing micro-spreads and exploiting inefficiencies between platforms with active arbitrage.

At the same time, liquidity providers of crypto are entities with significant capital that tend to underwrite large over-the-counter (OTC) deals, offering guaranteed execution size and price certainty. These entities negotiate block-trade facilities with institutional investors such as hedge funds, family offices, and corporate treasuries, mirroring traditional repurchase agreements in structure and counterparty diligence.

Top financial firms dominating crypto, such as DWF Labs, often combine roles of liquidity providers and market makers of crypto. This way, they increase their capabilities for concentrating depth, tightening spreads, and institutionalising risk controls. Their scale and technology advantage dwarf most retail participants, raising the bar for anyone seeking to supply meaningful liquidity to new digital assets.

Market Making and Liquidity Provisioning: Where DeFi Fits In

While institutional players anchor CEX and OTC trading domains, DeFi protocols have innovated on liquidity provision of crypto, effectively embedding market-making logic on-chain. There are four core mechanics to highlight.

AMM Liquidity Pools

Early models like Uniswap V2 introduced constant product pools of crypto liquidity, enabling permissionless liquidity providers (LPs) to deposit equal-value token pairs. Projects such as Balancer extended this with multi-asset pools and customisable weights, while Curve Finance optimised for low-slippage stablecoin swaps using specialised bonding curves and liquidity gauges.

Concentrated Liquidity

Uniswap V3, deployed in the mainnet in May 2021, allowed LPs to specify price ranges for providing liquidity using the Concentrated Liquidity technique, dramatically boosting capital efficiency. Third-generation AMMs like Velodrome and Kyber DMM further refined dynamic fee mechanisms and concentrated strategies, approaching capabilities of professional market makers.

On-Chain Order Books

Platforms such as Serum, dYdX, and Loopring implement decentralised order books, enabling smart-contract–driven limit orders and order-matching. Professional trading firms now deploy on-chain market-making algorithms, posting and managing quotes directly via smart contracts.

Modular Protocol Logic

A new mechanism of on-chain ‘hooks’ was introduced in Uniswap V4, the latest iteration of the prominent DEX released in the beginning of 2025. Hooks allow for injecting custom logic into swap, mint, and burn flows, enabling dynamic fee adjustments, oracle integrations, and bespoke risk controls without forking core contracts. Its unbundled architecture reduces gas costs and enhances composability, while support for permissioned pools allows gated participation ideal for institutional or compliance-sensitive use cases.

Liquidity Mining and Incentives

To bootstrap and sustain depth, many protocols introduced token incentives: yield farming on Yearn Vaults, Convex Finance’s Booster programme for Curve LPs, and Reward Gauges in Curve DAO, aligning LP returns with long-term governance and protocol health.

These innovations demonstrate that liquidity provisioning in DeFi has evolved far beyond passive LPs in simple AMMs. Active price-making tools, incentive mechanisms, and risk-management features now mirror traditional market making, even as challenges like impermanent loss, contract vulnerabilities, and fragmented capital persist.

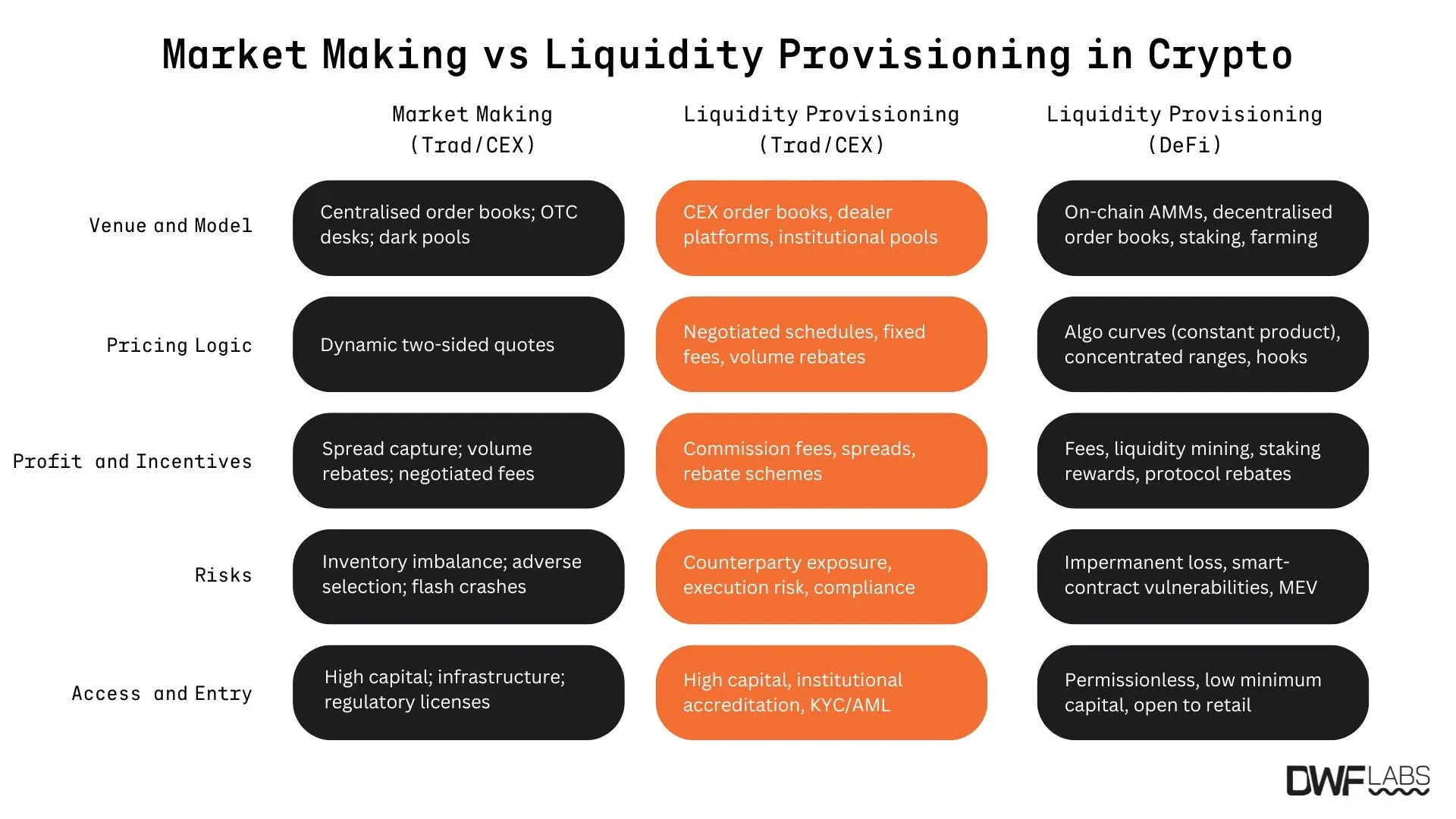

Comparison of Core Mechanics and Risks

Both liquidity providers and market makers in crypto face the fundamental task of allocating capital to ensure continuous trading and tight spreads. Traditional market makers and centralized liquidity providers must manage inventory imbalances, adverse selection, counterparty exposure, and evolving regulatory requirements, while DeFi liquidity providers contend with impermanent loss, smart-contract vulnerabilities and liquidity fragmentation. Moreover, crypto’s modular, cross-venue architectures and programmable incentives introduce unique dimensions, such as composability, on-chain credit facilities, and dynamic hook-based fees.

Towards a Converged Future

Several developments hint at a more integrated liquidity ecosystem:

- On-chain order books. Platforms like Serum and dYdX combine order-book models with DeFi’s transparency to offer a decentralised order book model, inviting professional market makers on chain.

- Tokenised liquidity rights. Firms are exploring NFTs or ERC-20 tokens representing liquidity commitments, enabling secondary trading of positions through tokenisation.

- Cross-platform aggregation. Smart routing now splits trades among CEXs and DEXs in real time (this mechanism is also known as liquidity routing), requiring seamless collaboration between market makers and pool-based LPs.

As these innovations mature, the lines between market makers and liquidity providers will continue to blur, with professional players further expanding into DeFi, all while adopting latest solutions for decentralised trading. Yet at their core lies the same imperative: allocate capital where it unlocks trading, narrows spreads, and supports efficient price discovery.

Final Thoughts

In traditional finance, roles of a market maker and liquidity provider have long been distinct yet complementary. In crypto, professional entities now straddle both, while retail LPs in DeFi occupy a supporting role. A forward-looking market participant must remain sceptical of simple labels and question how each model responds under stress, across chains, and within evolving regulatory frameworks.