In one of the previous articles, DWF Ventures covered the specifics and landscape of decentralised perpetual futures, including the evolution of existing perpetual DEXs and the potential developments in this space.

In this article, we will explore the current tokenomics landscape of perpetual DEXs, analyse the different mechanisms utilised by the protocols and discuss potential future developments.

Why Is Tokenomics Important?

Tokenomics is crucial to the growth and stability of a protocol. With the experiences of “DeFi Summer”, liquidity mining was successful in bootstrapping yield protocols in the early stage but was eventually unsustainable in the long run. The mechanism attracts mercenary capital which fostered a vicious cycle of ‘farming and dumping’, with farmers constantly searching for the next protocol offering higher yields while leaving the farmed protocol decimated.

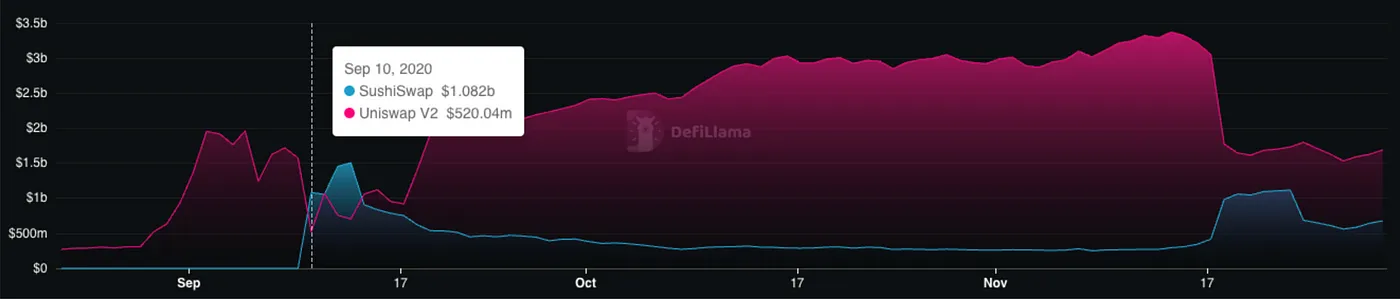

One example of this was Sushiswap’s vampire attack on Uniswap, which was successful in attracting significant TVL at first, but eventually proved unsustainable. Meanwhile, protocols like Aave and Uniswap managed to attract and retain their users sustainably with a product-first focus and sustainable tokenomics has helped in solidifying their positions as market leaders, a status they continue to maintain to this day.

While product-led growth is important, tokenomics serves as a distinguishing factor for crypto perpetual DEXs in a competitive market. Tokens represent how much users value a protocol based on its activity, similar to how stocks reflect the predicted performance of the companies. Unlike traditional markets, token prices often precede widespread awareness and growth for crypto projects.

Thus, it is important to have tokenomics that accrues value from the growth of the protocol. Ensuring that there is a sustainable token economy that provides sufficient incentives for new users to come in will be important as well. Overall, good tokenomics are key to achieving long-term growth and retaining value for the protocol.

Recap: The Perpetual DEXs Landscape

In our article about decentralised perpetual futures, we covered the evolution and mechanisms of perpetual DEXs extensively. Going into the tokenomics of these protocols: dYdX was one of the first to introduce perpetual contracts on-chain in 2020, and launched its token in September 2021. The token was generally known for high levels of inflation due to emissions from staking, LP and trading rewards as not much utility was provided for their holders apart from trading fee discounts.

Targeting the unsustainability of emissions was GMX, which entered the scene in September 2021. GMX was one of the first to introduce a Peer-to-Pool model and a fee sharing mechanism for users which garners yield from trading fees, paid out in majors and the native token. The success of it has also led to the creation of more Peer-to-Pool model systems, such as Gains Network. It differed in the collateralisation model and revenue sharing parameters, which had lower risk levied on users but produced lower yields as well.

Synthetix is another original DeFi protocol in the space, which supports multiple front-ends of perpetual and options exchanges, such as Kwenta, Polynomial, Lyra, dHEDGE, etc. It utilises a synthetic model whereby users must stake their SNX tokens as collateral to borrow sUSD for them to trade. Stakers receive sUSD fees that are generated from trading on all front-ends.

Mastering the Tokenomics of a Perp DEX

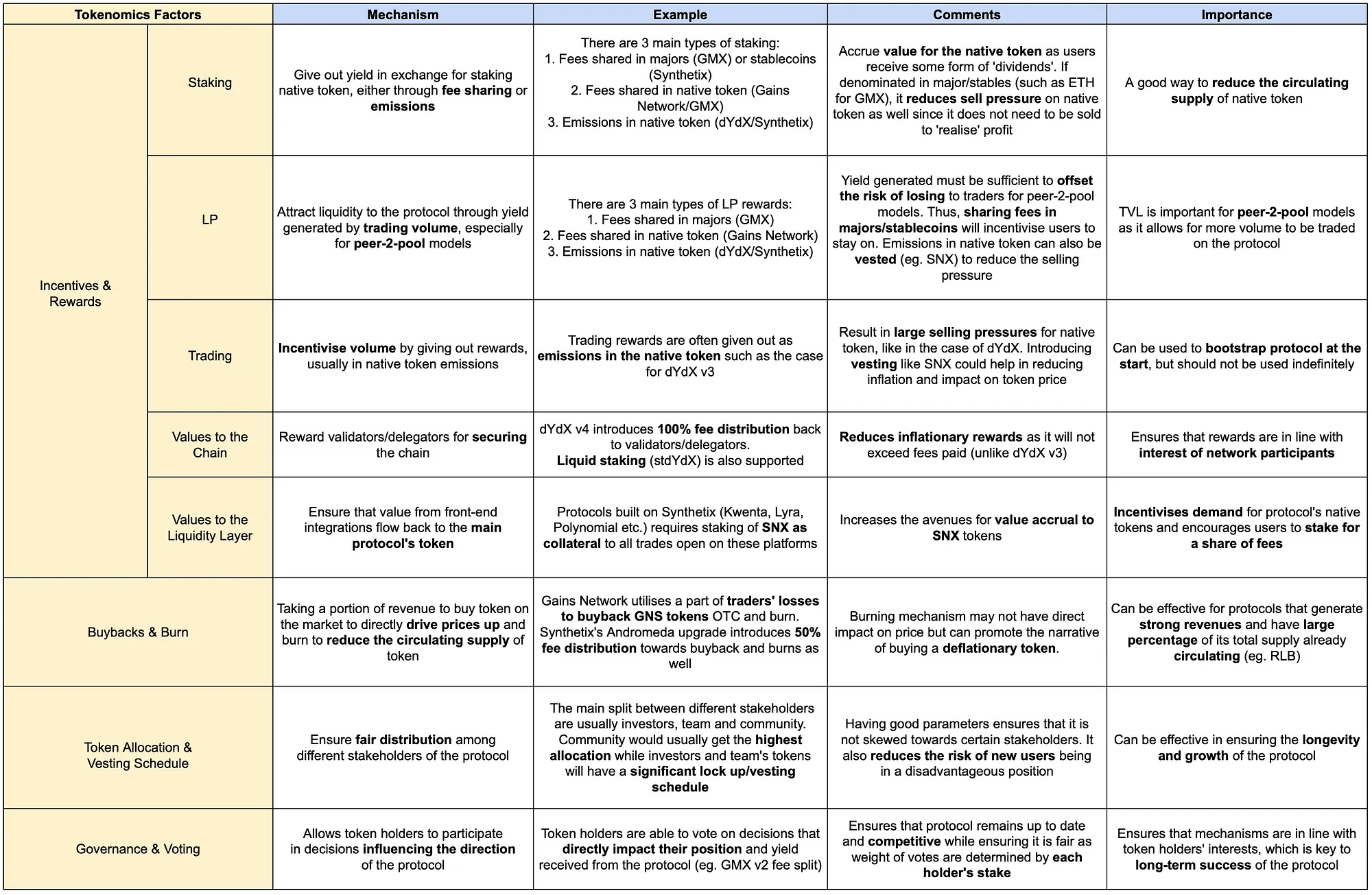

Designing good tokenomics involves careful consideration of various factors to create a system that aligns the incentives of participants, and ensure the long-term sustainability of the token. We discuss the various factors below based on the current landscape of perpetual DEXs tokenomics.

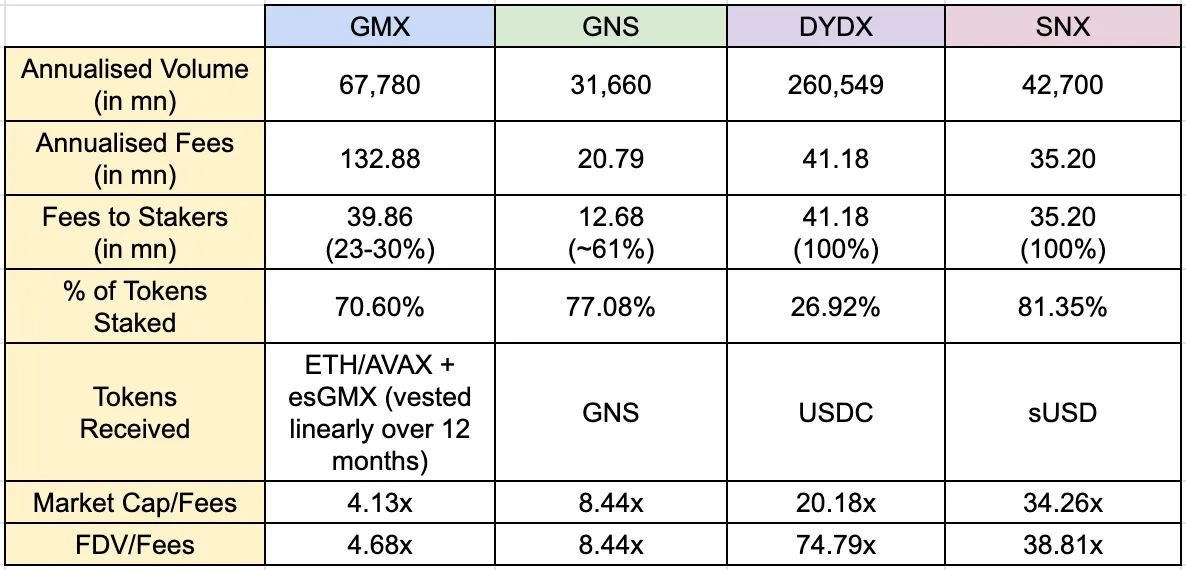

The table below shows the comparison between different crypto perpetual protocols and their tokenomics:

1. Incentives and Rewards

Incentives and rewards play an important role in encouraging desired behaviours. This includes staking, trading, or other mechanisms that encourage users to contribute to the protocol.

Staking

Staking is a mechanism that gives out yield in exchange for depositing the native token with the protocol. Yields received by users are either through revenue sharing from fees which can be in larger cap tokens/stablecoins or from native token emissions. From the protocols we analysed, there are 3 main types of staking:

- Fee sharing in majors or stablecoins.

- Fee sharing in native token.

- Emissions shared in native token.

As shown from the table, fee sharing has been effective in incentivising users to stake their tokens. For dYdX and Synthetix, the table reflects the recent changes made to tokenomics — including the introduction of 100% fee sharing for dYdX v4 and the elimination of inflationary SNX emissions.

Previously, dYdX v3 had a safety and liquidity staking pool which emitted inflationary DYDX rewards as the pools were not directly benefiting from the volume on the platform. Both pools were deprecated in Sept/Nov 2022 after a vote by the community as it did not really serve its purpose and was not efficient for the DYDX token as well. With v4, there are fees accrued from trading volume that is given back to stakers, incentivising users to stake for yield.

GMX utilises a mix of two types of staking for their rewards, sharing fees in majors (ETH/AVAX) as well as their native token. GMX, Gains Network and Synthetix have very high rates of tokens staked, signalling that the rewards are sufficient to incentivise users to provide upfront capital and maintain their stake within the protocol. It is hard to determine what is the ideal mechanism, but having a portion of fees paid out in majors/stables and introducing vesting for emissions in native tokens has been effective so far.

Overall, staking has the following benefits:

- Reduce the circulating supply of tokens (and selling pressure). Only works if the yield generated is not pure emissions to ensure sustainability. Having the yield generated in majors or stablecoins will reduce the selling pressure as users do not have to sell to “realise” their yield

- Value accrual to staked token. The token can indirectly grow in value as the protocol grows and fees generated per token increase. Having a stable yield for the token can attract non-traders to enter just to earn yield as well.

Nonetheless, there are several factors to consider for staking based on the protocol’s goals. The first one is the longevity and type of rewards. Having stable rewards will be important given that users who are more risk-averse need not sell off the tokens to ‘realise’ their yield. The rate of emission is also important to ensure that the yield users receive are not too volatile and can be sustained over a period of time.

The second factor is rewarding the right users. Having a lower barrier to entry and ease of earning rewards (no upfront capital, no vesting, etc.) will likely attract mercenary users that will dilute the rewards of active users (active traders, long term stakers etc.).

Here are our thoughts. Staking is common in most protocols to reduce the circulating supply of the token. It is a good way to align interests with users especially if staking is required for collateral (e.g. SNX), it reduces the volatility of users’ position through returns in yield. The effects of staking will be more positive and long-term if rewards are given out on a portion of fees and in majors/stables, which would be suitable for most perpetual DEXs that are doing decent volumes.

Liquidity Providers (LPs)

Liquidity Providers (LPs) are essential to a perpetual DEX, especially for Peer-to-Pool models as it would allow them to support more volume on the platform. For Peer-to-Pool models, LPs become counterparties to traders on the platform. As a result, the yield shared from fees must be sufficient to offset the risk of losing to traders.

For orderbook models like dYdX, LPs serve as a way for users to earn rewards. However, most TVL still comes from market makers and rewards emitted in DYDX were pure inflation. Thus, the LP module being deprecated in October 2022. An exception would be Synthetix whereby stakers are technically LPs on the platforms integrated with it (Kwenta, Polynomial, dHEDGE etc.) and earn fees from trading volume.

GMX and Gains Network both utilise peer-2-pool models that require LPs as counterparties to the trades performed on the platform. Comparing both protocols:

- GLP has significantly higher TVL than gDAI, possibly due to higher yield.

- gDAI users have lower risk of losing with trader’s wins being backstopped by GNS minting, while GMX pays out users’ funds from GLP.

- Users who are more risk averse will be attracted to GLP with higher yields while users who are less can deposit into gDAI despite lower yields

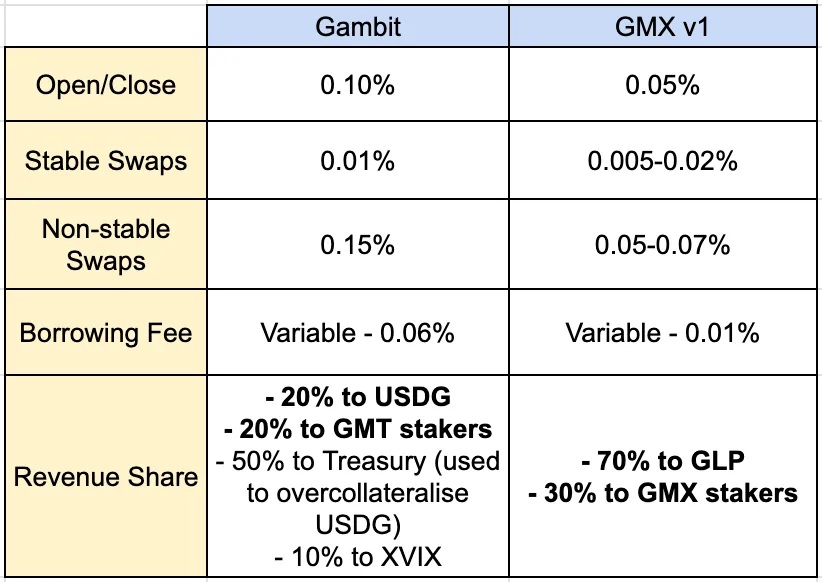

The mechanism of Gains Network is similar to the predecessor of GMX, also known as Gambit Financial on BNB. Gambit generated quite a lot of volume and TVL upon launch. While Gambit and GMX shared similar characteristics on the Peer-to-Pool model and revenue sharing mechanism, their parameters differed from one another.

While Gambit gained decent traction, GMX on Arbitrum exploded in terms of trading volume and users after making changes in their tokenomics and structure. Based on the examples, we have noticed these key changes:

- Providing most revenue shares to stakers/LPs. Gambit only allocated 40% of revenue share (20% to USDG + 20% to Gambit stakers) back to holders/stakers, while GMX v1 allocated 100% (70% to GLP + 30% to GMX stakers). Increasing the amount of yield directed to stakers/LPs generated a good narrative that appealed to a wider audience apart from just pure traders.

- Transferring risks towards LPs as the direct counterparty. Gambit only allocated 20% revenue share to USDG while GMX allocated 70% revenue share to GLP. Both USDG and GLP are minted by depositing whitelisted assets to provide liquidity for platform trades. The reason Gambit offered lower yield to LP is that USDG is a stablecoin and the platform directed 50% revenue share as collateralisation to ensure the redemption of funds for LPs. In contrast, GMX shifts the risk to LPs who bear the brunt of traders’ wins or losses.

From the case studies of Gains Network, Gambit and GMX, shows that increased LP yields can incentivise greater liquidity as compared to the protocol absorbing some risk. With GMX v2, slight changes were made to the tokenomics which reduced the fee share to stakers and GLP holders by 10%. Details on the adjustment:

- GMX V1: 30% allocated to GMX stakers, 70% to GLP providers.

- GMX V2: 27% allocated to GMX stakers, 63% to GLP providers, 8.2% to the protocol treasury, and 1.2% to Chainlink, which has been approved by a community vote.

Community members were largely supportive of the vote, and the continued growth of GMX V2’s TVL signals that the change was positive for the protocol.

There are benefits to rewarding LPs significantly, especially for Peer-to-Pool models whereby they are one of the key stakeholders:

- Enhanced stickiness towards the protocol through stable yield. It means reduced risks of LPs of losing their initial capital. Coupled with stable yield, it reduces the inertia of shifting their positions as they do not need to liquidate their tokens to ‘realise’ yield. This mechanism does not work for dYdX v3 given the volatility in yield which is emitted in their native token.

- Value accrual to native token. For GMX, the growth of GLP and volume on the platform indirectly increases the value of GMX in terms of fees generated per token, which was a great driver of demand for the token.

Among the factors to consider is the adjustment of LP risks of LP for the protocol. LPs can face risk for both Peer-to-Pool and orderbook models if parameters are not changed according to risk and market conditions. SNX stakers lost $2m recently to a market manipulation incident on TRB, as OI caps were set as an amount of TRB tokens and not the USD amount. GLP holders have largely been benefiting from traders’ losses in the past but there are questions on the sustainability of the mechanism. With the change in tokenomics, it could bepossible that any significant traders’ wins can be backstopped by the protocol treasury.

We think that this mechanism is crucial for Peer-to-Pool models as incentivising crypto liquidity from users is needed for growth. GMX has been effective in doing so over time with a high percentage of revenue share and accruing traders’ losses. While there are risks for LPs when traders win, we believe that the yield of a midsize protocol can offset that risk significantly. Thus, we believe that incentivising LPs sufficiently will be important for bootstrapping a strong user base.

Trading

Trading rewards are mainly used to incentivise volume as they are mostly emissions, usually in the protocol’s native token. Rewards are usually calculated as a percentage of trading volume/fees against the total rewards scheduled for a certain period.

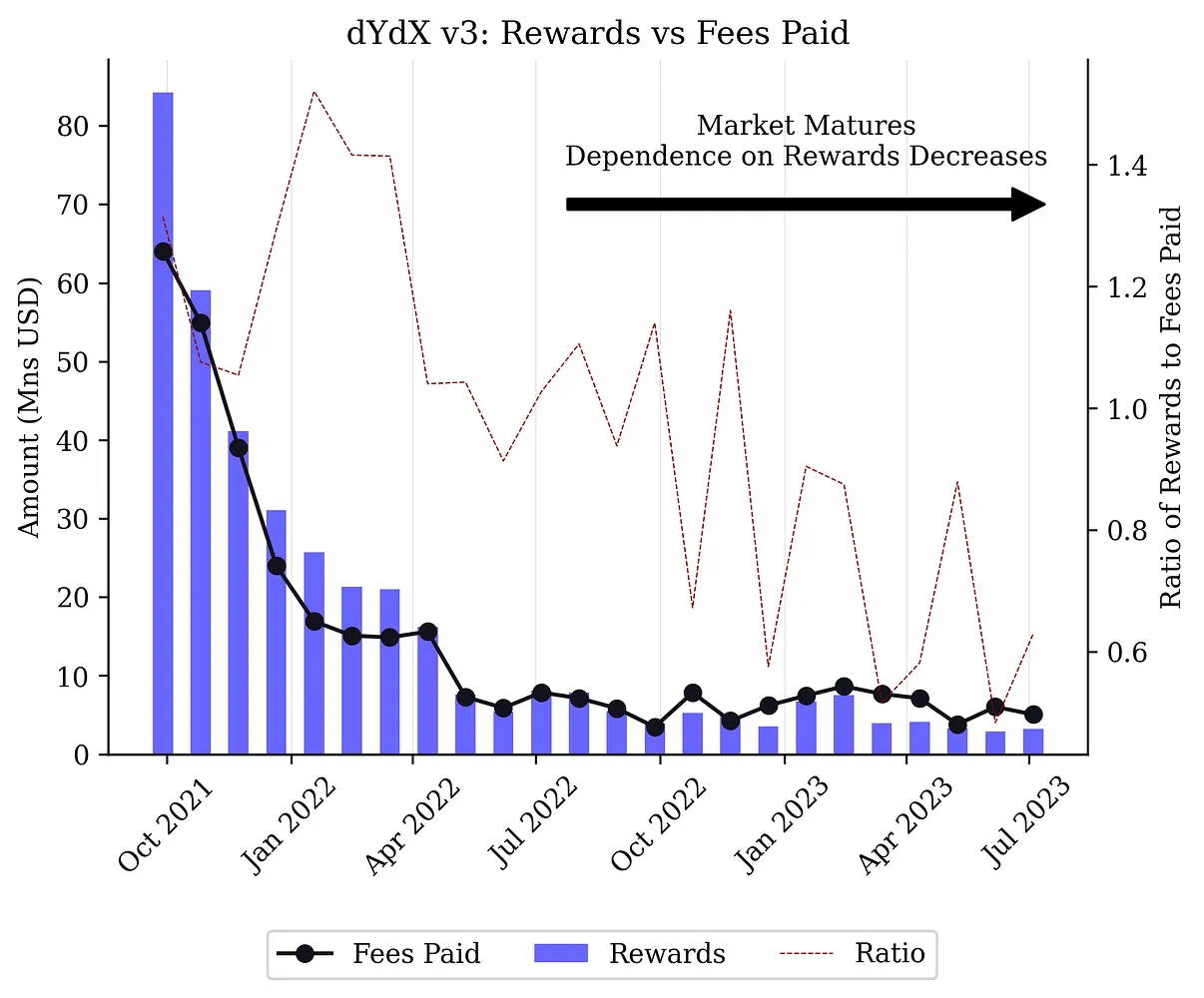

For dYdX v3, the total supply reserved for trading rewards was 25% and was the main source of emission in the first 2 years. As a result, the amount of trading rewards was often more than the amount of fees paid by traders, which means that token emissions were highly inflationary. With little incentive to hold (mainly only for trading fee discounts), it resulted in large selling pressures for DYDX over time. This changes for dYdX v4, which are explored in the section below.

Kwenta had also enabled trading rewards to traders on the platform, capped at 5% of the total supply. It requires users to stake KWENTA and carry out trades on the platform to be eligible. Rewards are determined by a percentage of staked KWENTA and trading fees paid multiplied together, which means that rewards do not exceed the upfront cost (staked capital + trading fees) of users. Rewards are subjected to a 12 month escrow, and rewards can be reduced by up to 90% if users want to vest their rewards early.

Overall, a clear benefit to introducing trading rewards would be additional incentive volumes in the short term. With dYdX V3 rewards, traders were essentially getting paid to trade, which helped in driving volume up.

However, it is advisable to ponder, which type of users the protocol wants to attract. For dYdX, the ease of qualifying for the rewards and lack of vesting terms would have likely attracted many short term users that dilute rewards away from real users. For Kwenta, the requirement of upfront capital and vesting terms would have made it unattractive for short term users — which could reduce the dilution of rewards for long term users.

We think that trading rewards could be an effective way to bootstrap a protocol at the start, but should not be used indefinitely given that constant emissions will reduce the value of the token. It should also not take up a significant percentage of supply and inflation per month, and vesting would be important for protocols to spread out selling pressure over time.

Value Accruals to the Chain

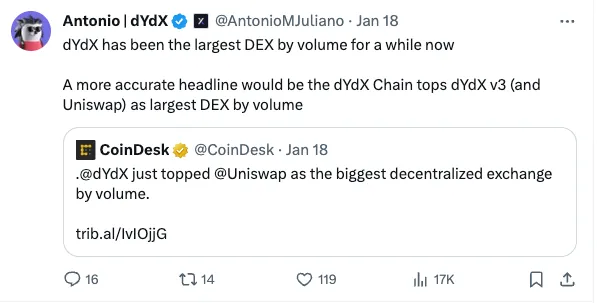

Let us unveil the details in this part using a case study of dYdX. The launch of dYdX Chain has marked a new milestone for the protocol. On January 18, 2024, dYdX Chain even once passed Uniswap as the biggest DEX by volume.

Going forward, we would potentially see more perpetual DEXs following such footsteps. The main changes from the updated tokenomics for the dYdX Chain include the staking for supporting security, not only for generating yields. In V3, rewards in the Safety Pool were given out as DYDX token emissions but was eventually winded down after the community voted in favour in DIP 17. In V4, the dYdX Chain requires the staking of dYdX tokens for validators to run and secure the chain. Delegation (staking) is an important process whereby a staker delegates validators to perform network validation and block creation.

Additionally, 100% of transaction fees will be distributed to delegators and validators. In V3, all fees generated were collected by the dYdX team, which has been a concern for some in the community. In contrast, the V4 made all fees, including trading fees and gas fees, to be distributed to the delegators (stakers) and validators. This new mechanism is much more decentralised and aligned with the interest of network participants. PoS stakers (delegators) can choose the validator to stake their dYdX tokens and in turn, receive revenue share from their validators. The commission to delegators (stakers) ranges from a minimum of 5% to a maximum of 100%. Currently, according to Mintscan, the average validator commission rate on the dYdX Chain is 6.82%.

On top of these changes, the new trading incentives also ensure that rewards do not exceed fees paid. This is an important factor, as many concerns around V3 were on the inflationary and unsustainable tokenomics which was updated along the way, but with little impact on the token performance. The issue of being able to “gamify” rewards was brought up by Xenophon Labs and other community members, which has also been discussed several times in the past.

In V4, users can only earn trading rewards up to 90% net trading fees paid to the network. This will lead to an improved demand (fees) vs supply (rewards) balance and control token inflations. Rewards are capped at 50,000 DYDX per day and will last for 6 months, ensuring that the inflation will not be significant.

We believe that dYdX Chain is at the forefront of the industry towards greater decentralisation The validation process plays several crucial roles in the new chain: securing the network, voting on on-chain proposals, and distributing staking rewards to the stakers. Coupled with the 100% fee distribution back to stakers and validators, it ensures that rewards are aligned with the interests of network participants.

Value Accruals to the Liquidity Hub

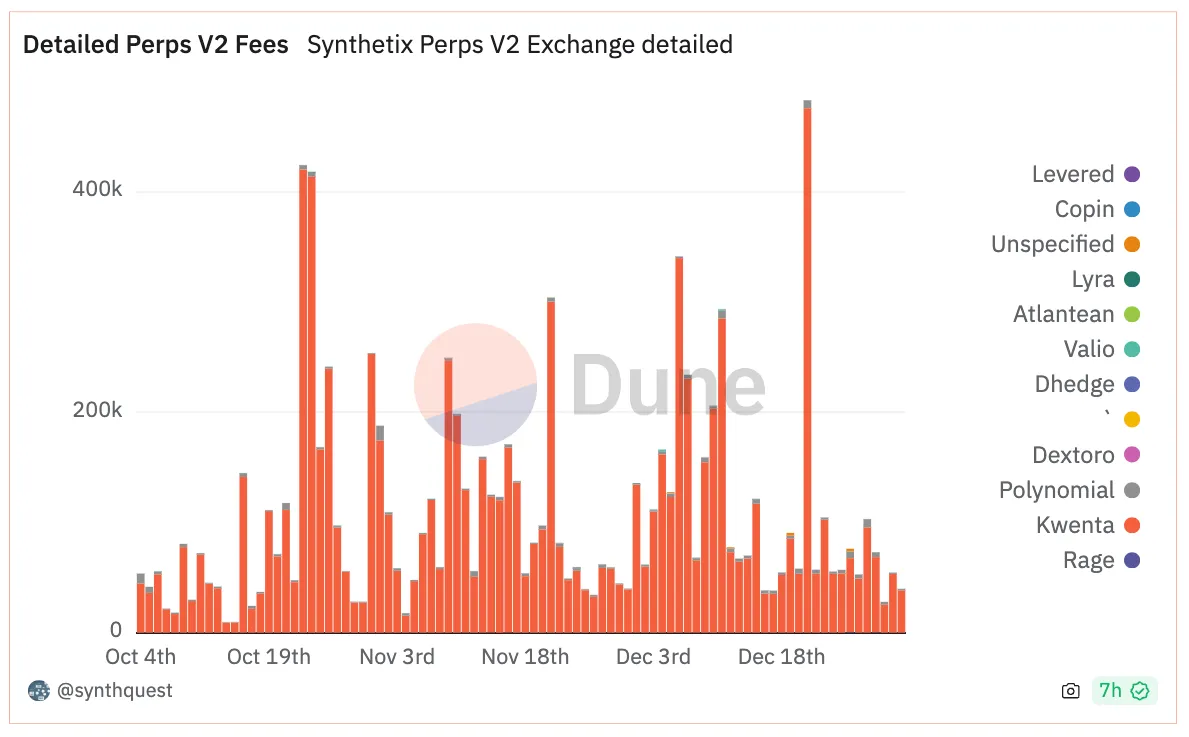

Synthetix serves as a liquidity hub for multiple front-ends of perpetuals and options exchanges, such as Kwenta, Polynomial, Lyra, dHEDGE. These integrators have created their own custom features, built their own communities, and provide users with trading frontends.

Among all integrators, Kwenta is the leading perpetual exchange that drives most volume and fees to the entire Synthetix platform. Synthetix is able to capture the values brought by Kwenta and other exchanges, and the success is contributed by Synthetix’s tokenomics. The key reasons are:

- Staking SNX is the first required step to trade on integrators. Even with their own governance token, Kwenta only quotes its asset prices against sUSD, which can only be minted by staking SNX tokens. Apart from Kwenta, other integrators like Lyra and 1inch & Curve (Atomic Swaps) also utilise sUSD and thus SNX tokens. Therefore, the front-end integrators of Synthetix are allowing value accruals to the SNX tokens.

- Liquidity hub’s rewards distribution to integrators. In April 2023, Synthetix announced exciting news of giving out their massive Optimism (OP) token allocation to traders. For 20 weeks, Synthetix gave out 300,000 OP tokens per week, while Kwenta gave out 30,000 OP per week. The protocol was able to attract higher trading volume and fees from Q2 to Q3 2023. This had been a major catalyst for Synthetix price growth.

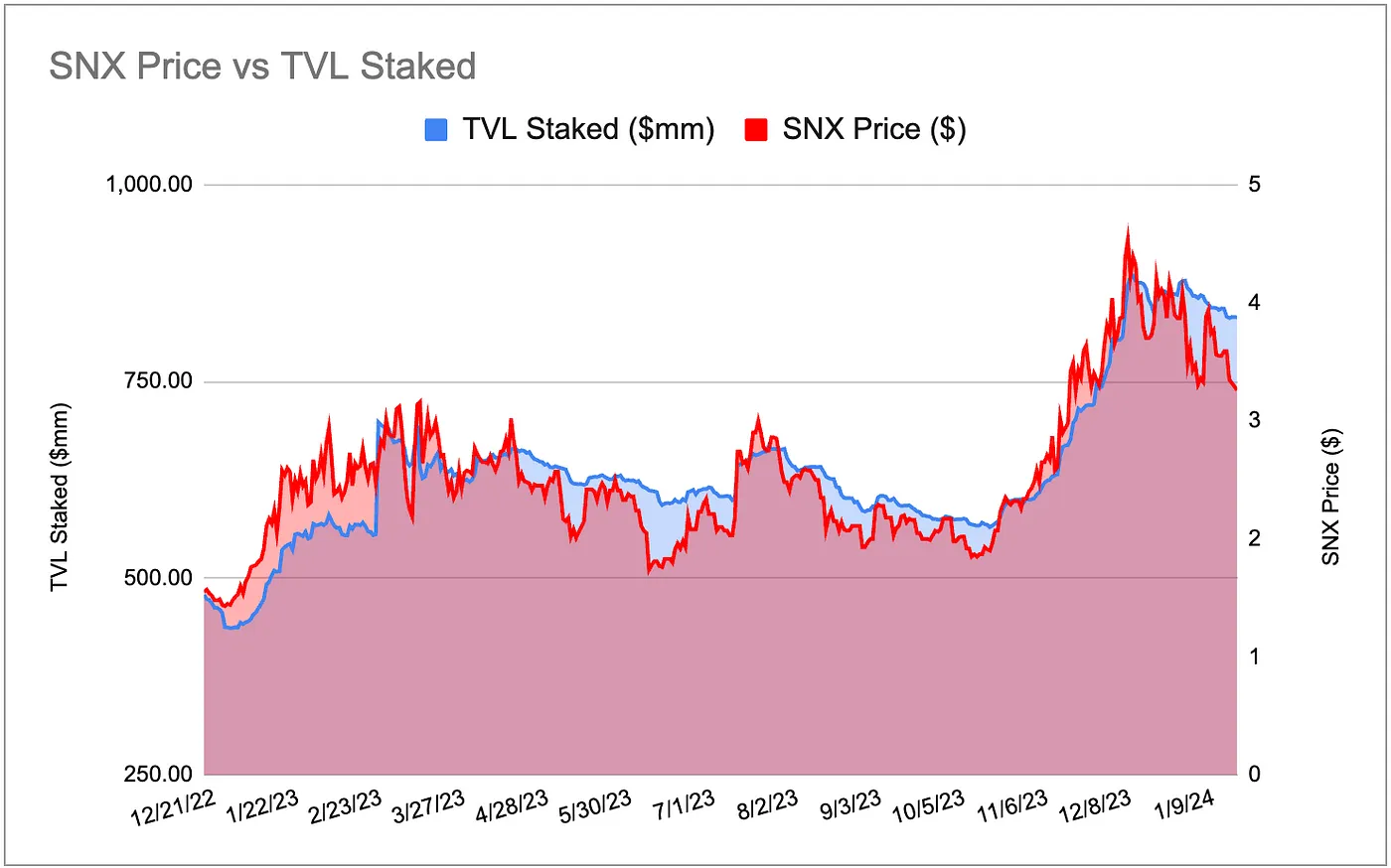

We can see from the chart that the amount of staked SNX TVL has been highly correlated to the price performance of SNX. As of 22 Jan 2022, Synthetix had around $832 million worth of staked TVL. They had the highest percentage of tokens staked (81.35%) compared to dYdX, GMX, and Gains Network.

In our opinion, for a liquidity hub, relationships should be mutually beneficial. While Synthetix is providing liquidity to these integrators, it is also receiving values from these integrators in terms of fees from trading volume that indirectly drives Synthetix’s TVL. With greater demand for trading on their integrators, this will lead to increased demand and lower selling pressure for SNX, which indirectly drives up the value of the token. Therefore, it is beneficial for Synthetix and its token holders to collaborate with more front-end integrators.

2. Buybacks and Burn

Buybacks can be done by taking a portion of revenue to buy the token on the market to directly drive prices up or burn to reduce the circulating supply of the token. This reduces the circulating supply of a token, which has the allure of raising prices in the future due to reduced supply.

Gains Network has a buyback and burn program whereby depending on the collateralisation of gDAI, a percentage of trader’s losses can be directed to buy back and burn GNS. The mechanism has resulted in the burn of over 606,000 GNS tokens, equivalent to about 1.78% of the current supply. Due to the dynamic nature of GNS supply through its mint and burn mechanism, it is unclear whether the buyback and burn has a significant impact on the price of the token. Nonetheless, it is one way to counter the inflation of GNS which has kept supply hovering between 30–33m in the past year.

Synthetix has recently voted to introduce a buyback and burn mechanism as part of its Andromeda upgrade. The proposal potentially sparked renewed interest in SNX, as stakers receive a double-sided effect on their position of staking for fees and holding a deflationary token. This reduces the risk of the pure staking as the allocation for the buyback and burn can be used as a backstop for any incidents such as what happened with TRB.

Key benefits of the mechanism:

- Ability to control/reduce supply. This ensures that token holders are not diluted over time by emissions from rewards or other stakeholders’ tokens.

- Incentivises users to hold onto token. Holders and stakers of the token get additional utility of earning rewards combined with holding an asset that is ‘deflationary’.

However, the effects of buybacks is also largely dependent on the revenue of the protocol to maintain the significance of burning. Without a steady stream of revenue, the mechanism will be unsustainable and its reduced impact can disincentivise users to keep holding onto the token.

We think that the burning mechanism may not have a direct impact on price yet can promote the narrative of buying a deflationary token. This was largely effective for protocols that generate strong revenues and have a large percentage of their total supply already circulating (eg. RLB). Thus, it would be ideal to be used for protocols like Synthetix that are already established and do not have much supply inflation.

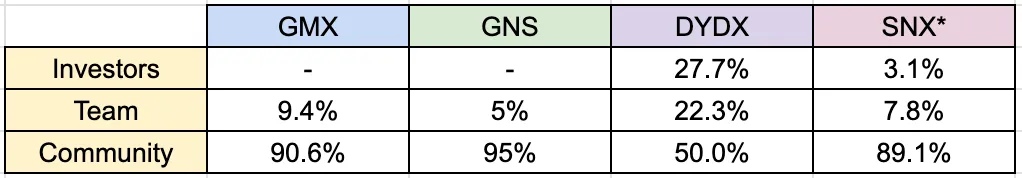

3. Token Allocations and Vesting Schedule

Taking note of token allocations and vesting schedules of different stakeholders are important to ensure that the parameters are not skewed towards certain stakeholders. For most protocols, the main split between stakeholders are the investors, team and the community. For community tokens, this includes airdrop, public sale, rewards and DAO tokens etc.

Some observations as we looked through the allocations and vesting for these protocols:

- GMX and Gains Network are outliers in terms of having fundraised only from the public sale of tokens. Having a ‘community-owned’ protocol could reduce users’ concerns about investors’ overhead and incentivise them to hold the token and engage with the protocol.

- dYdX and Synthetix both had significant supply reserved for investors — 27.7% and 50% (at the start before supply changes). However, dYdX had a long cliff of around 2 years while Synthetix had a 3 months cliff with 4 quarterly unlocks after TGE.

- GMX and Gains Network both converted from another token to the current one, which meant that the majority of the supply was already unlocked upon launch. This means that further emissions from rewards in the future will be minimal as a percentage of the circulating supply.

- dYdX and Synthetix both had a substantial amount of supply (>=50%) reserved for rewards. However, dYdX rewards were pure emissions while Synthetix gave out a part of fees + emissions that were vested over 12 months. This reduced the inflation of SNX in comparison to DYDX.

There is no clear formula for token allocation or vesting as the stakeholders and mechanisms employed differ largely from protocol to protocol. Nonetheless, we believe the factors below would generally lead to favourable tokenomics for all stakeholders.

In our opinion, the community should be allocated the most tokens. Token allocation for the team should not be too much, and the vesting schedule should be longer than most stakeholders as it could signal their conviction in the project. Investors’ tokens should have the smallest allocation and vest for a substantial amount of time. Emissions should be spread out over a period of time and include some form of vesting to prevent significant inflation at any point in time.

4. Governance and Voting

Governance is important for perpetual DEXs, given it empowers token holders to participate in the decision-making processes and influence the direction of the protocol. Some decisions that can be made by governance include:

- Protocol upgrades and maintenance. Perpetual DEXs are often subject to upgrades and improvements to enhance functionality, scalability, and growth. This ensures that the protocol remains up-to-date and competitive. For example, in GMX’s recent snapshots, the governance passed the proposals of creating a BNB market on GMX V2 (Arbitrum) and GMX V2 fee split.

- Risk management and security. Token holders can collectively decide on collateral requirements, liquidation mechanisms, bug bounties, or emergency measures in the event of a breach or exploit. This helps to protect user funds and build trust in the protocol. The recent incident encountered by Synthetix due to TRB price volatility led to a $2 million loss for stakers. This highlights the importance of consistently reviewing parameters, adding volatility circuit breakers, and adding increased sensitivity to the skew parameters on pricing volatility spikes.

- Liquidity and user incentives. Token holders can propose and vote on strategies to incentivise liquidity providers, adjust fee structures, or introduce mechanisms that enhance liquidity provision. For example, the governance of dYdX had passed on the V4 Launch Incentives proposal.

- Decentralised community with transparency. Governance is supposed to build decentralised communities with transparency and accountability. Publicly accessible governance processes and on-chain voting mechanisms provide transparency in decision-making. For example, DEXs like dYdX, Synthetix, GMX adopt on-chain voting mechanisms to foster decentralisation.

From our point of view, governance helps create a robust and inclusive community for stakeholders involved in the decentralised perpetual exchanges. Having on-chain voting mechanisms and transparency in decision making builds trust between stakeholders and the protocol as the process is fair and accountable to the public. Thus, governance is a key feature of most crypto protocols.

Experimenting with New Mechanisms

Apart from the factors mentioned above, we believe that there are many other innovative ways to introduce additional utility and incentivise demand for tokens. Protocols will need to prioritise in introducing new mechanisms, based on which stakeholders they are targeting and what would be the most important to them. The table below shows the key stakeholders and their key concerns:

Given the wide range of concerns, it would not be possible to cater to all stakeholders. Hence, it is important for a protocol to reward the right group of users to ensure sustained growth. We believe that there is room to introduce new mechanisms that can better balance the interests of different stakeholders.

Conclusion

Tokenomics is a core part of any crypto protocol. There is no clear formula for determining successful tokenomics as there are numerous factors that influence performance, including those that lie beyond a project’s control. Regardless, the crypto market is fast moving and constantly changing, which highlights the importance of being responsive and the ability to adapt based on the market. From the examples above, it showed that experimenting with new mechanisms could be very effective at achieving exponential growth as well.

We believe there is further room for growth in experimenting with tokenomics, and, as the crypto venture capital firm, DWF Ventures is dedicated to supporting the teams building in this space. Interested parties can also pitch their project to DWF Ventures using the on-page form.