With most altcoins underperforming in the current market, both institutional and retail traders are searching for alternative ways to generate income. One increasingly popular approach is yields, the return or profit generated from staking digital assets.

Pendle Finance is reshaping DeFi (Decentralised Finance) by introducing yield tokenisation, which enables users to trade, hedge, or lock in future yield independently of the principal of an asset. This mechanism is offering ways to onboard institutional liquidity to operate on-chain. Onboarding institutional liquidity to operate on-chain is crucial for enhancing market depth, improving efficiency, and increasing overall stability in DeFi, ultimately bridging the gap between traditional finance and decentralised markets.

Pendle's Performance and Growth

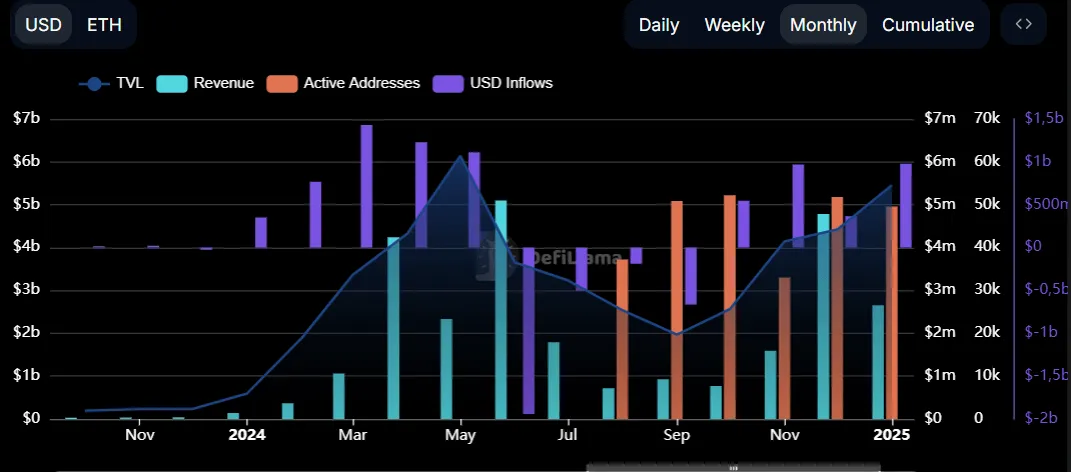

Pendle has experienced exceptional growth, with its TVL (Total Value Locked) surging 20x — from $230 million to $4.4 billion between 2023 and 2024. This growth has been largely driven by the rise of restaking since 2024. Restaking is an emerging concept in DeFi that allows users to reuse their staked assets to secure additional protocols or networks, effectively compounding their yield opportunities. Instead of staking assets like ETH once and earning a single yield, restaking enables users to leverage the same assets multiple times to generate additional rewards.

By interacting with Pendle, users can also receive airdrops from projects such as EigenLayer and Renzo, making it an attractive platform for DeFi participants.

At its peak, Pendle recorded $6 billion+ in TVL and $5 million in monthly revenue.

What is Yield Tokenisation?

Yield tokenisation allows users to trade, hedge, or lock in future yield independently of the principal. This unlocks new opportunities for capital efficiency and risk management.

How does it work?

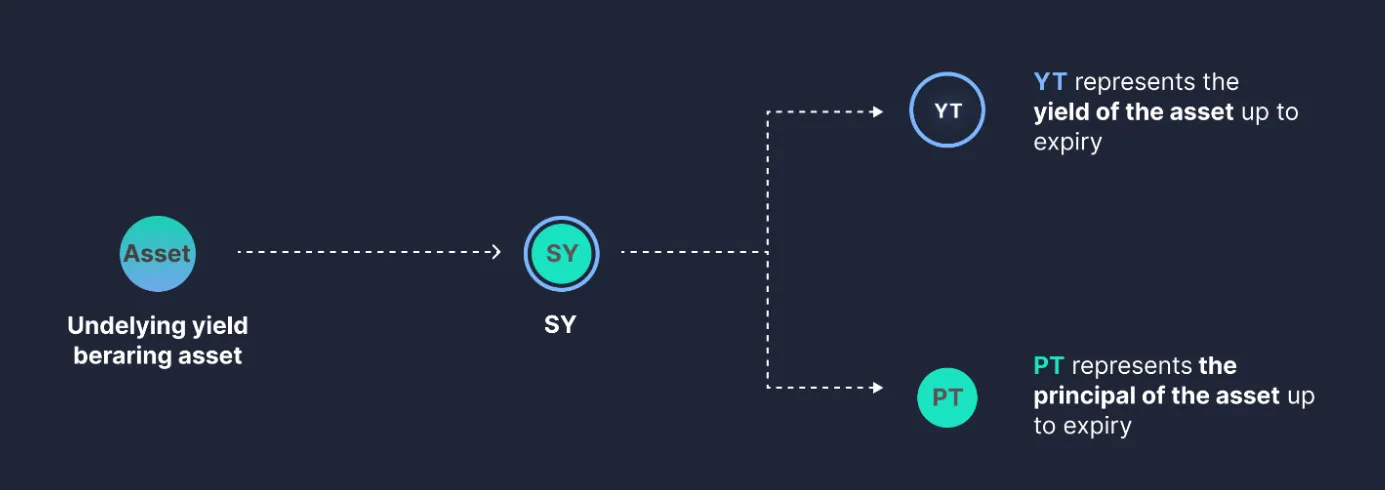

- Pendle wraps yield-bearing tokens (e.g., stETH) into SY (Standardised Yield) tokens, making them compatible with the Pendle AMM (Automated Market Maker).

- SY tokens are then split into two tradable assets:

- Principal Token (PT): Represents the underlying asset’s value but does not accrue yield over time. At maturity, PT can be redeemed for the original asset, and the use case is ideal for those who want to buy assets at a discount and hold until maturity for a fixed return.

- Yield Token (YT): Represents the right to claim future yield. YT holders receive all yield payouts until expiration, but the token itself expires at maturity. Yield tokens are suitable for traders seeking leveraged yield exposure or those looking to hedge against yield fluctuations.

This structure allows users to choose how they interact with yield — locking in fixed returns, speculating on future yield, or optimising their portfolios.

Example: How Yield Tokenisation Works with stETH

To illustrate, let’s consider how an investor might use Pendle with stETH (staked ETH):

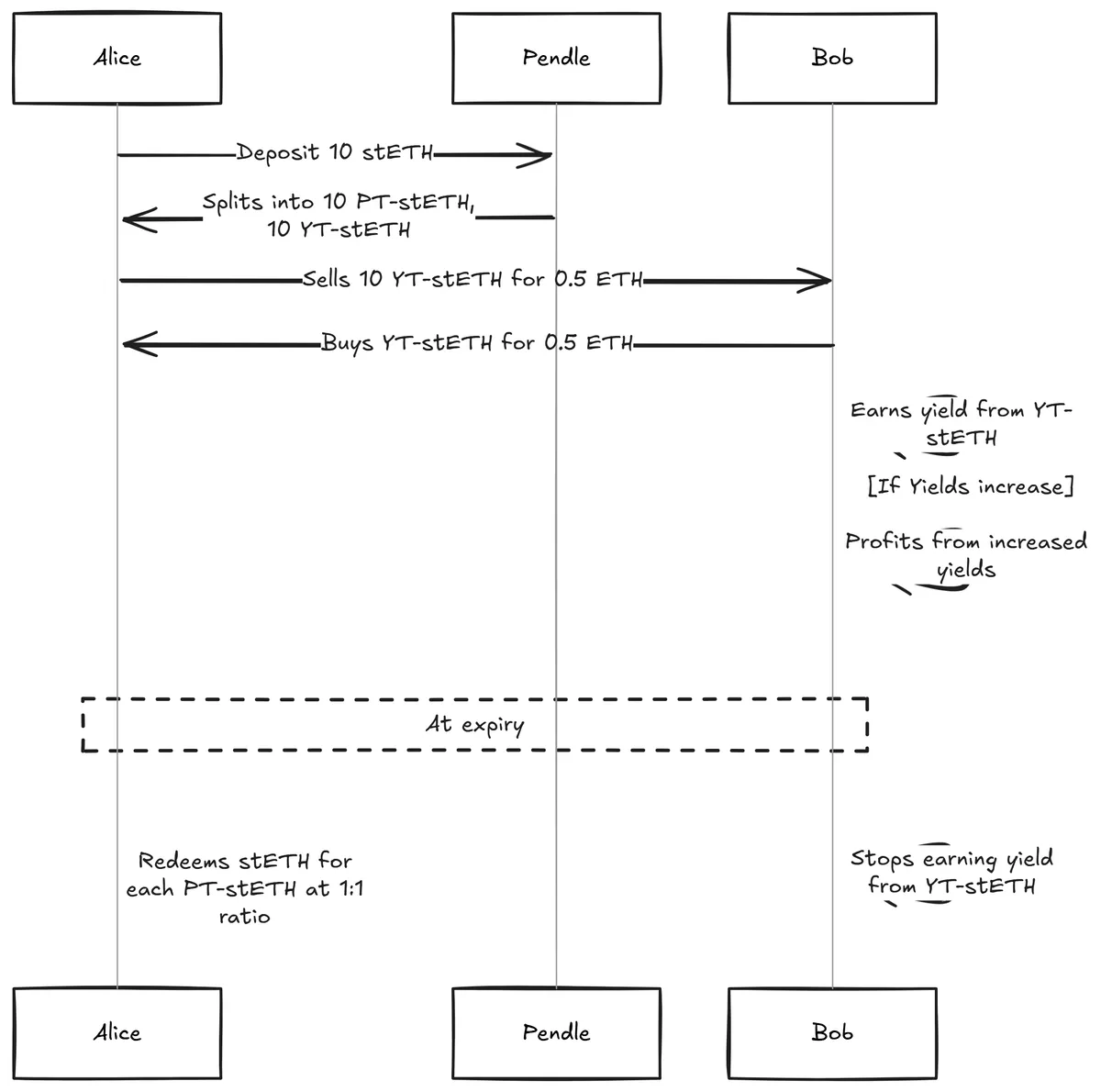

1. Monetising Future Yield

- Alice deposits 10 stETH into Pendle, receiving:

- 10 PT-stETH (representing her principal)

- 10 YT-stETH (representing future yield)

- She immediately sells her 10 YT-stETH for 0.5 ETH in Pendle’s marketplace, effectively locking in an upfront profit.

- Since YT-stETH entitles the holder to the yield generated by 10 stETH, the buyer (Bob) is now entitled to these yield payments.

- This allows Alice to realise her future yield today, rather than waiting for it to accrue over time.

2. Hedging Against Yield Fluctuations

- Yield rates in DeFi can be volatile. If Alice expects stETH yield to decrease, selling YT-stETH protects her from potentially lower returns.

- Bob, on the other hand, is betting that yield rates will remain high or increase, making YT-stETH a profitable purchase for him.

- This creates a market for yield speculation, where different risk appetites can be balanced.

3. Yield Collection & Redemption at Expiry

- Suppose the annual yield on stETH is 7%:

- Bob, who holds 10 YT-stETH, earns 0.7 stETH over the year.

- Alice, who sold her YT-stETH, does not receive any yield but still retains her 10 PT-stETH.

- At expiry, Alice redeems her 10 PT-stETH for her original 10 stETH, fully recovering her principal.

This mechanism allows users to monetise their future yield and hedge against changes in yield rates.

Why Pendle Matters in This Market

In the current environment, trading spot or perpetual contracts has been challenging for many participants. Crypto markets are highly volatile, making it difficult for traders to predict price movements accurately, and many assets suffer from low liquidity, leading to wider spreads and slippage, making execution less efficient. As a result, institutions, whales, and retail traders are increasingly looking for yield capitalisation opportunities with assets like BTC, ETH, and stablecoins.

Pendle enables these traders to lock in fixed yields to hedge against market volatility and trade future yield to maximise returns. This flexibility makes Pendle a valuable tool for both conservative and aggressive yield strategies.

Pendle’s AMM and Yield Trading

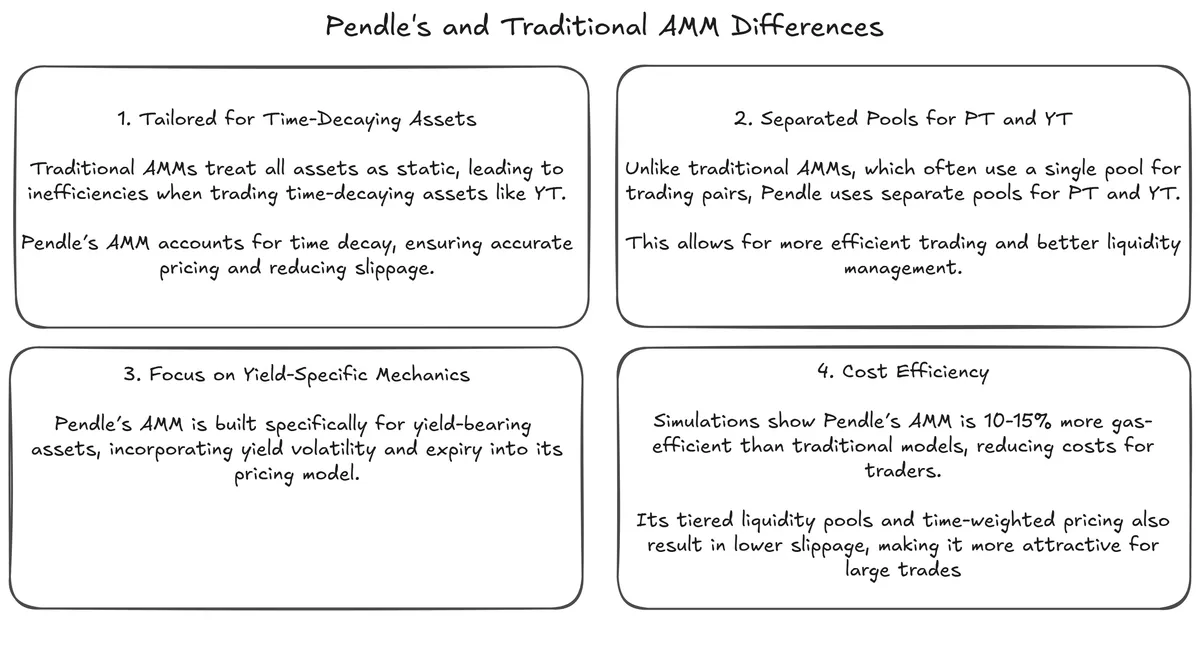

Beyond yield tokenisation, Pendle’s V2 AMM (Automated Market Maker) plays a crucial role in optimising yield trading.

Pendle’s AMM is specifically designed for trading yield, leveraging the unique behaviours of PT and YT tokens to enhance capital efficiency.

This innovation allows for deep liquidity and efficient pricing, making it easier for users to interact with yield markets.

The Road Ahead for Pendle

Pendle aims to become the leading gateway for yield trading across multiple financial sectors. The team has outlined several key developments for the future:

1) Enhancements to Pendle V2

Pendle is enhancing its ecosystem by allowing third parties to create their own yield markets, expanding opportunities for users. Additionally, the platform plans to introduce dynamic fee structures to optimise trading efficiency. Improvements to governance will also be made, giving vePENDLE holders more voting options to shape the protocol’s future.

2) Building Citadels

Pendle is planning to expand beyond Ethereum-based ecosystems by integrating with non-EVM chains such as Solana and TON, broadening its reach across different blockchain networks. Additionally, the platform aims to develop KYC-compliant products to cater to institutional investors seeking regulatory-compliant DeFi solutions. To further enhance accessibility, Pendle is also working on Shariah-compliant financial offerings, ensuring that its products align with the needs of diverse global markets.

3) Boros Initiative

Pendle is expanding its capabilities by supporting a diverse range of yield sources, including funding rates, to provide users more opportunities for yield generation. Additionally, the platform is developing advanced tools for hedging and yield optimisation, enabling users to better manage risk and maximise returns in volatile market conditions.

These initiatives position Pendle as a long-term player in the evolving DeFi landscape.