As of April 2025, token buybacks are emerging as a powerful mechanism for value redistribution and protocol sustainability in the blockchain economy. With more protocols achieving profitability, buybacks are increasingly employed to reward long-term users, reduce circulating supply, and foster positive reflexive dynamics.

DWF Ventures has been closely monitoring this trend, analysing how various protocols implement buyback strategies and their potential implications for stakeholders and token performance. Let’s dive in.

Why Buybacks Matter in Web3

In traditional finance, stock buybacks are a familiar strategy used by companies to reduce circulating shares and boost shareholder value. In crypto, the concept has been adapted with greater flexibility and broader utility tailored to blockchain ecosystems.

Instead of focusing solely on price appreciation, token buybacks can help projects build protocol-owned liquidity, lower total supply through token burns, or reallocate tokens to the community via governance and incentive programs. This level of adaptability allows teams to fine-tune tokenomics in real time, aligning economic models with evolving market dynamics.

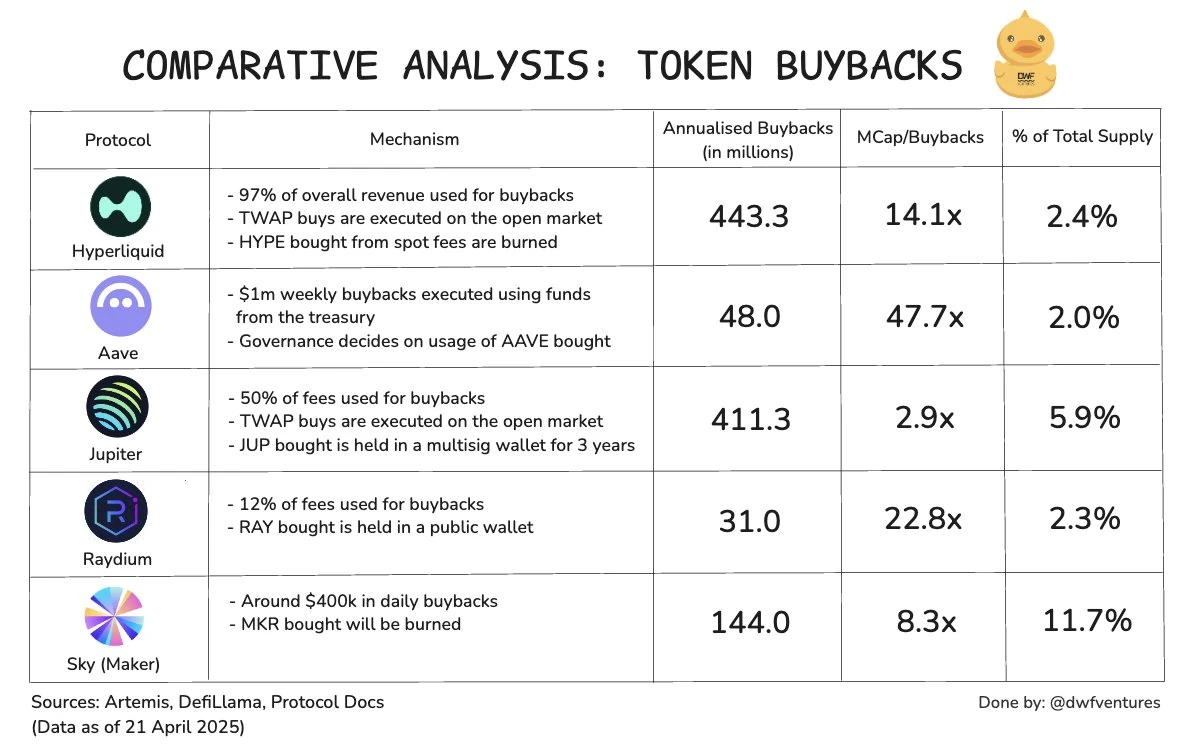

We summarised buyback strategies adopted by some of the major DeFi protocols in the table below:

Image by DWF Ventures. Source: Artemis, DefiLama, Protocol Docs

When implemented effectively, buybacks can do more than support token value. They strengthen trust, enhance capital efficiency, and demonstrate a long-term commitment to users and stakeholders. And as the concept evolved in crypto, several mechanisms for executing token buybacks have emerged—each with its own strengths and trade-offs.

Revenue-Based Buybacks

Blockchain protocols with reliable revenue streams often allocate a portion of their earnings to token buybacks, creating sustained buy pressure and reinforcing long-term token value.

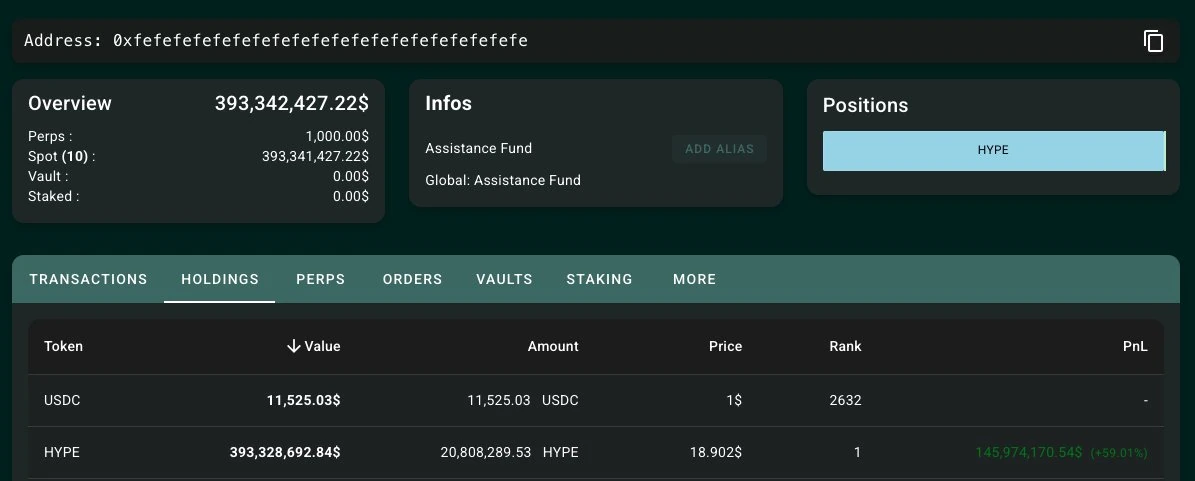

A prime example is Hyperliquid, which has committed a large share of its revenue to buybacks through its Assistance Fund. Since launch, the protocol has repurchased over 20 million HYPE tokens—equivalent to roughly $386 million, or 6.2% of its circulating supply.

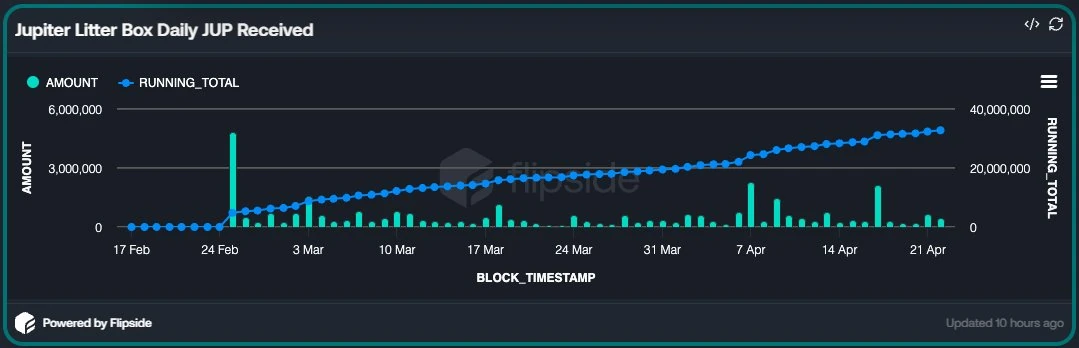

Other notable crypto projects have adopted similar strategies. Jupiter Exchange allocates 50% of its protocol fees to buybacks, one of the highest fee shares in the space. This has led to the strongest market cap-to-buyback ratio among all major protocols. Raydium, meanwhile, contributes 12% of its fees to buybacks, still significant, especially given its steady usage and liquidity depth.

These models demonstrate how revenue-driven buybacks can reinforce token demand, reward long-term holders, and help stabilise protocol-owned liquidity over time.

Treasury-Funded Buybacks

Some mature protocols take a different approach by funding buybacks directly from their treasury reserves. This model is typically adopted by projects with strong capital buffers and established track records of network activity, offering more predictability compared to revenue-based strategies.

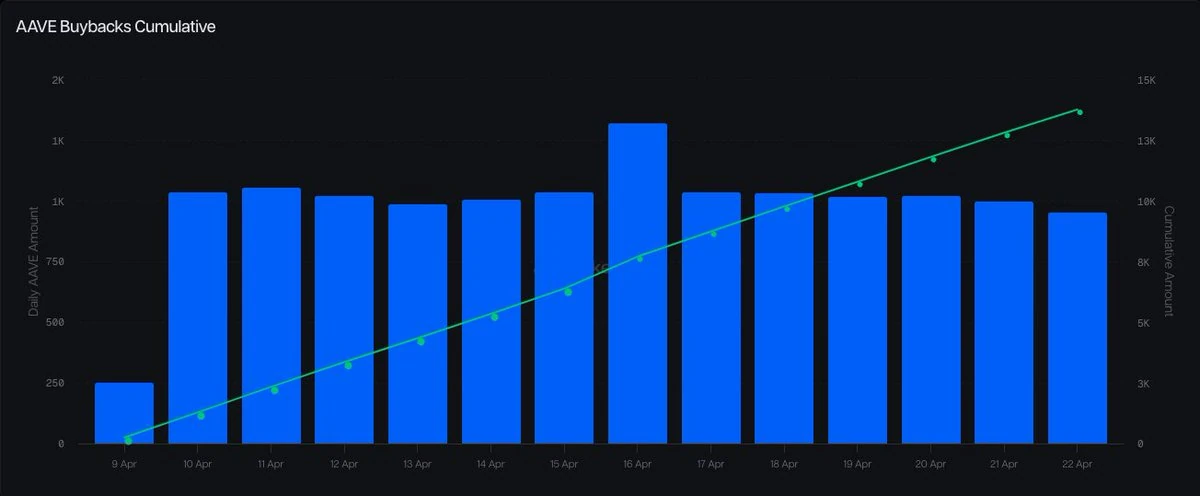

Aave is a recent example. In April 2025, this lending protocol approved a proposal to begin weekly buybacks of $1 million, with plans to continue the program for at least six months. Similarly, Sky (former MakerDAO) has maintained a long-standing buyback initiative, maintaining a long-running buyback program with daily volumes of around $400,000, supported by its surplus treasury.

While this approach provides stability, it relies on careful treasury management and strong community alignment on how funds should be used to support the protocol’s long-term value. In cases where protocols want to reduce supply more aggressively, burning tokens becomes a popular alternative to redistributing them.

Token Burns: Permanent Supply Reduction

One of the more aggressive and impactful forms of buybacks involves permanently removing cryptocurrency from circulation through burns. By reducing supply in this way, protocols can introduce scarcity, which may help support long-term token value.

Sky stands out in this area, burning 100% of the tokens it repurchases. As of mid-2025, the protocol has removed approximately 2.2% of its total token supply, making it one of the most committed burn-driven ecosystems in the space. But what happens to tokens that aren’t burnt? The way protocols handle accumulated tokens post-buyback is just as crucial.

How Protocols Use Bought-Back Tokens

As protocols accumulate tokens through buybacks, how those tokens are used or retired becomes just as important as the buybacks themselves. Many teams choose to redistribute them through governance, a model adopted by Aave and Sky, which ensures long-term alignment with the protocol’s most active users and stakeholders.

In other cases, buyback profits are held in reserve for future incentives. Hyperliquid, for example, has accumulated around $146 million in profits, which gives the team significant flexibility to support growth initiatives or reinforce tokenholder rewards.

But while buybacks can be a powerful tool, they’re not a substitute for product-market fit. Protocols must continue to deliver value and maintain strong fundamentals to generate the revenue that fuels buybacks in the first place.

Sustainable buyback programs rely on consistent usage, competitive performance, and an expanding user base. If the token value is expected to rise over time, the protocol must be growing in lockstep with increasing fees, real demand, and ongoing adoption reinforcing the flywheel. While some have already implemented well-defined strategies, others are just getting started, and the list of buyback adopters continues to grow.

More Protocols Joining the Buyback Trend

The momentum behind token buybacks continues to grow, with an increasing number of protocols either launching initiatives or actively exploring them through community governance.

In April 2025, Orca's governance council approved a significant proposal involving a $10 million buyback program. This initiative also includes burning 25% of the total token supply, aiming to create scarcity and drive demand.

KaitoAI has also entered the buyback arena. In March 2025, an investor repurchased 579,000 KAITO tokens (valued at approximately $1.39 million) from Binance at an average price of $2.40. This move followed an airdrop and subsequent sell-off, indicating a strategic effort to stabilise and support the token's value.

dYdX, one of the most noteworthy decentralised derivatives exchanges, launched its first-ever $DYDX Buyback Program in March 2025. The program allocates 25% of net protocol fees to monthly buybacks, systematically acquiring DYDX from the open market and staking it to enhance network security. This initiative has been well received, with the token's price experiencing a notable increase following the announcement.

Meanwhile, Jito is actively discussing a proposed buyback framework within its governance forum. The proposal suggests a programmatic buyback mechanism, potentially adjusting buyback amounts based on market signals and internal protocol conditions. While still in the discussion phase, this indicates Jito's interest in adopting buyback strategies to align with its long-term goals.

This wave of activity reflects a broader trend: as more protocols reach profitability, buybacks are becoming a preferred tool for returning value to stakeholders and reinforcing tokenholder alignment.

Summing Up

Buybacks are increasingly becoming a central pillar of tokenomics across the decentralised ecosystem. Whether driven by revenue, treasury funds, or governance, they offer protocols a flexible way to reward long-term participants, manage supply, and reinforce their commitment to sustainable growth.

For a deeper perspective on how buybacks and burns can be used at different stages of protocol maturity, explore this article by Decentralised.co.

If you’re building in the Web3 space, and are interested in partnering with a crypto venture capital fund, don’t hesitate to contact DWF Ventures.